Don’t spend more than you earn

Debt is a very slippery, slope, and you will forever be chasing repayments and never have financial freedom if you remain in debt. You have to remember, interest on debt is essentially money thrown in the bin. I personally got my first job when I was 16, and my first full time job when I was 20. I got into debt straight away, and it’s taken me over 8 years to pay it all off. Within that time, not only have I paid thousands of pounds in interest to the banks, I’ve also missed out on thousands of pound in potential growth from savings and investments.

The best thing to do, is just save up your money for the things you may wish to buy – otherwise everything costs you a LOT more thank you think.

Budget your money

You may not think it matters – I definitely didn’t when I was younger – but knowing what money you have coming in and out each month will save you from overdrafts, and help you make sure you have enough money to put towards savings and investments on a regular basis.

All you need to do, is work out how much money you have coming in, what you need to use to live (i.e. pay your bills, eat) and from there you decide what you can put aside for short term or long term savings. Ideally if you really want to keep on top of your finances, setting up a regular contribution in your savings is a good idea – so that you don’t even miss having it in your bank account as you don’t see it there!

Put money aside for your future

It’s really important to get into the habit of putting money aside for your future, as soon as possible.

The longer you save for, the more you can take advantage of something called compound interest. In very simple terms, compound interest works as follows:

You start off with £1,000. You potentially earn £10 interest on this.

In the next period, you will be earning interest on £1,010 so you might make £11 in interest.

Then, your starting point in the next period is £1,021 and so on…

Now, once you’ve decided how much money you are able to save, you should have a think about whether you want to save it or invest it.

The current interest rates on cash savings are very low (correct as at 15/01/2021) – it’s really difficult to get a savings account that pays you interest higher than inflation, which means your money can potentially lose value by staying in a low interest account. If you can take the risk that shares will go down as well as up, then investing might be a better option for some/all of your savings.

Invest your money

The value you will get by saving and investing from a young age is indescribable. I used to think – much like you probably do now – that worrying about things like buying a house, having children or retiring didn’t matter when I was a teenager, by OH MY GOD do I wish I had at least set aside 10-20% of my earnings regularly from a young age. I would have been able to buy my flat with a smaller mortgage. I would be able to achieve financial freedom much quicker – and not have to rely on a 9-5 job to pay my bills.

“Having an emergency savings account is KEY: but anything above that isn’t worth keeping in savings accounts at the moment considering the awful interest rates.

With today’s low interest rates (correct at 15/02/21), it can be difficult to find a savings account that can give you a return above the current inflation rate – i.e. if your money sits in your bank account, it will lose value over time. So it’s worth considering investments which have the potential to outperform inflation if we look at historical returns. Just remember…. Past performance is not an indicator of future performance.

Let’s look at this really simple example of how compounding returns work in your favour as a teenager. In reality it’s a little more complex, but it will help you understand the basic concept.

Historically, the S&P500 index (i.e. the index of the top 500 companies in the US) has returned 8-10% per year.

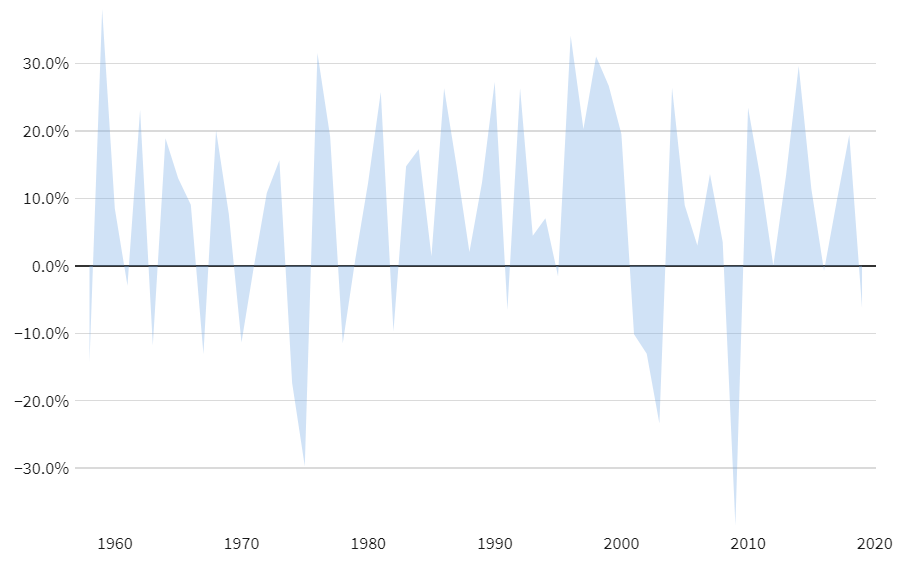

S&P 500 Historical Annual Returns

For illustrative purposes let’s assume a modest 7% return per year, in order to be prudent.

For example, if you invested £200 a month for 10 years from 16-26, assuming a standard stock market 7% return, you’re looking at around £11,000 of compound returns – of course, that’s assuming you re-invest any dividends.

Now, if you invested £400 a month for 5 years (same total £25,000 invested), from the ages of 21 to 26, you’re looking at only £5,000 in compound returns, essentially losing out on £6,000 of extra compound growth!

Now investing when you’re a young adult can be daunting, so let’s quickly break down your options.

Firstly, under 18’s

If you are currently under 18, you may already hold a Child Trust Fund.

Child Trust Funds were started off with a voucher that the UK government gave to children born in the UK between 1 September 2002 and 2 January 2011. Some of these are simply savings accounts, and some are investment accounts like the one Columbia Threadneedle offers. They were replaced by Junior ISA’s from 2011 which had the the same tax protections but didn’t get the government voucher to start them off.

If you don’t known what an ISA is, it’s basically a tax wrapper for your money – so you won’t pay any tax on the interest your money makes (if it’s in a savings account), or any increases in the value of your investments (i.e. Capital Gains).

If you don’t known what an ISA is, it’s basically a tax wrapper for your money – so you won’t pay any tax on the interest your money makes (if it’s in a savings account), or any increases in the value of your investments (i.e. Capital Gains).

Once you are 16 you’re able to choose to become responsible for your own Child Trust Fund or Junior ISA. Although you can’t taken anything out of it until you’re 18, you can start to make your own investment decisions including changing the provider or what you are invested into.

Do some research

- Speak to your parents and find out if there is already a Child Trust Fund or Junior ISA set up for you. You can’t have both a Child Trust Fund and a Junior ISA.

- If you have an account, find out what it’s invested into and what it’s worth. Does anyone make regular contributions into it? Can you start to make contributions into it yourself?

Now, if you are approach or are over 18

- If you already hold a Child Trust Fund, and it’s about to mature/ has matured, you should consider moving the investment you’ve already built up and continue building upon it using regular savings (As mentioned in the previous point!) You’ll be SO tempted to spend it, but trust me you’ll thank me later if you don’t! Find out which options are available to you with CT.

- If you don’t currently hold either a Child Trust Fund or Junior ISA, I would still suggest opening a brand new ISA (which CT offer along with a General Investment Account) and regularly contributing to it. The beauty of an Investment ISA with a place like CT, is that you don’t have to think about what investment decisions to make. Investing into individual companies and making the decisions yourself is risky, whereas the CT accounts have fund manager who make the decisions on your behalf in order to maximise your returns. Find out more about CT’s Investment Trusts.

Hopefully you’ve found this article useful, and you’ve realised that making good financial choices when you’re a young adult will set you up for success in later life. Money might not be everything, but it plays a huge role in our freedom and freedom IS happiness.