Investors are increasingly seeking to understand and measure the wider consequences of where they allocate their capital. In this article, we look at how the UN Sustainable Development Goals (SDGs) can help to inform investor choices.

According to the United Nations Conference on Trade and Development (UNCTAD) the overall additional investment needed is between US$5 trillion and US$7 trillion. In developing countries specifically, there is an investment gap of about $2.5 trillion.1

What’s more, with global assets under management now at $84.9 trillion and growing, the industry offers policymakers a significant pool of capital to help progress towards the goals. The gap for many investors, however, is in finding the right strategies to help achieve tangible results that will draw us closer to achieving the SDGs.2

The SDG Journey

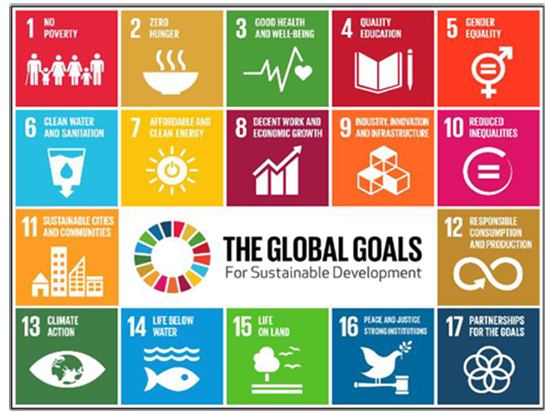

The UN launched the SDGs (see below) in 2015 as a framework of sustainable development priorities to replace the expiring Millennium Development Goals. They were designed to galvanise sustainability efforts by explicitly calling on businesses across developed and emerging markets to apply creativity and innovation to solve a wide range of development challenges. Companies are encouraged to use the SDGs to shape, steer and report on their sustainability strategies. Asset managers can do the same.

For asset owners, investing responsibly offers more than just helping to meet supranational targets. Evidence is mounting of the potential for higher returns from investing in sustainable businesses, as well as investments which capitalise on associated themes such as renewable energy.

Navigating challenges

SDG-themed investing, while fast growing, faces challenges. One of the most obvious is the sheer number of goals, which we address by consolidating them into umbrella categories. For example, focussing on climate could incorporate goal seven, “Affordable and Clean Energy”, and goal 13, “Climate Action”. Alternatively, some investors adopt a laser-like focus only on those which are most relevant to them. Both approaches are feasible, but consolidating or selecting from the 17 goals is recommended to increase the likelihood of results.

There are several approaches that asset managers can take to align their investment strategies to the SDGs, being mindful of the different degrees of alignment with, or achievement of, the SDGs through different asset classes.

Alternative asset classes are a case in point, as they can be vital contributors to specific SDGs when capital is allocated to new businesses and projects instrumental to their delivery. Infrastructure, for instance, is at the heart of goal nine, “Industry, innovation and infrastructure”, which emphasises the need for “quality, reliable, sustainable and resilient infrastructure to support economic development and human well-being, with a focus on affordable and equitable access for all”.

However, while such activity may be high impact and tangible, these opportunities are often inaccessible to the majority of investors. The IFC’s asset management arm, for example, offers targeted exposure in the private equity space to projects at the sharp end of the SDGs, including investing in women-owned enterprises in emerging markets (with direct relevance to goals five and 10, respectively: “Gender Equality” and “Reduced Inequalities”) and resource efficiency and clean technology in Asia (aligned with goal seven, “Affordable and Clean Energy”), all with exceptional financial returns. The drawback is that this is only available to a tiny proportion of the largest global investors.

While broader progress towards the goals as an investment strategy may be more accessible, it can be tough to measure. But processes and standards are evolving to give investors better insight into the links between their investments and achieving the SDGs.

The fixed income advantage

The green bond market, eight years old at the time of the SDGs’ launch, has continued to evolve in tandem with a wider sustainability bond market. Last November’s Social Bond from the African Development Bank, for instance, mapped to seven different SDGs across a range of themes (from goal one, “No Poverty”, to goal six, “Clean Water and Sanitation”). On the developed market side, the Community of Madrid has issued numerous sustainability bonds which map to seven SDGs, with projects spanning medication through to subsidised public transport for low income groups, linked to goal 11, “Sustainable Cities and Communities”.

There is more clarity expected on how SDGs can be mapped to these vehicles. Columbia Threadneedle Investments is a member of the ICMA Social Bonds Working Group and, specifically, a newly launched work stream which will look at alignment between social bonds and the SDGs.

Bonds are an effective tool for impact precisely because there is the capacity and transparency to measure their outcomes directly. This is not so simple in equities. While thematic funds have long been available to investors, they often lack clarity in defining their impact and breadth across the SDGs. Typically, the majority take environmental issues, or more recently gender, as a core theme. In the past few months we have seen a number of pooled funds come to market purportedly targeting a wide range of SDGs, but they are notably absent of criteria and standards on what qualifies as “impact”. It is positive to see the market broadening, but investors looking at these funds should be aware of their actual holdings, and realistic about their potential for SDG delivery.

Bright future

There are signs the market is growing more standardised. We are part of a UN Principles for Responsible Investment working group developing an “Impact Market Map” to help identify companies delivering sustainable impact aligned with the SDGs. We are also finding new ways to assess the contribution of investee companies through an SDG lens, alongside more traditional ESG measures.

We should all get behind efforts to create one common framework that businesses, governments and individuals can collectively use for investing in sustainable development. Growing interest of asset owners in the implications of their investments is a huge opportunity to progress the SDGs. While not without its complexities, this sends a clear signal to the market that investment capital, free markets and finance can be a solution to some of the world’s most pressing challenges.