In this edition we focus on the increasingly discussed spectre of inflation resurfacing and bond yields rising, as

economic growth gathers momentum and supply shortages see many commodities and manufacturing components

post dramatic double-digit price rises. Ultimately, we consider the implications for pension scheme funding.

“Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit-man.”

Ronald Reagan,

(40th US President, 1981-1989)

Inflation – a brief retrospective

Back in 1996, a highly readable economic text, The Death of Inflation¹ was published to widespread acclaim.

Coming after the severe inflations of the 1970s, 1980s and early 1990s,² the idea that UK inflation had finally

been tamed, and possibly consigned to the history books, was quite a revelation. And so it has largely proved,

over an exceptional 25 year period characterised by many central banks gaining operational independence (from

political interference) when setting monetary policy, the advent and disappearance of the Goldilocks economy,3

and a number of mini and full scale financial crises – notably the 2008/09 global financial crisis which caused

UK GDP to contract for five consecutive quarters and not recover its end-2007 level until late-2013.4

The latest force to dampen inflationary pressures has, of course, been the recession caused by the global

pandemic. Unprecedented in modern times, the UK economy contracted by a massive 9.8% in 2020, the

steepest drop in GDP since records began in 1948.5 However, with the success of the Covid-19 vaccination

programme in many countries and the global economy beginning to reopen again, robust, well above par, GDP

growth is widely expected to materialise, quite feasibly culminating in UK output being back to 2019 levels by the

end of this year. However, this stimulus to hitherto latent demand has been accompanied by supply shortages in

many commodities (energy, non precious metals and foodstuffs) and essential manufacturing components, such

as semi conductors, leading to expectations of rising price inflation. The crucial question, of course, is whether

the end result will be a temporary blip in inflation or something more deeply entrenched and enduring.

Pandemics, inflation and bond yields

Delving into the history books can be instructive in that inflation has historically been a function of business

cycles, supply side shocks, such as wars and oil price crises and political interference in monetary policy.

But has it also been a consequence of pandemics?

Accepting that history rarely repeats itself to the letter, a recent study by The Centre for Economic Policy

Research (CEPR) policy portal, VoxEU,6 concluded, “The economic consequences of Covid-19 are often compared

to a war, prompting fears of rising inflation and high bond yields. However, historically, pandemics and wars have

had diverging effects… [in] that both inflation and bond yields typically rise in wartime but remain relatively stable

during pandemics. Although every such event is unique, history suggests high inflation and bond yields are not

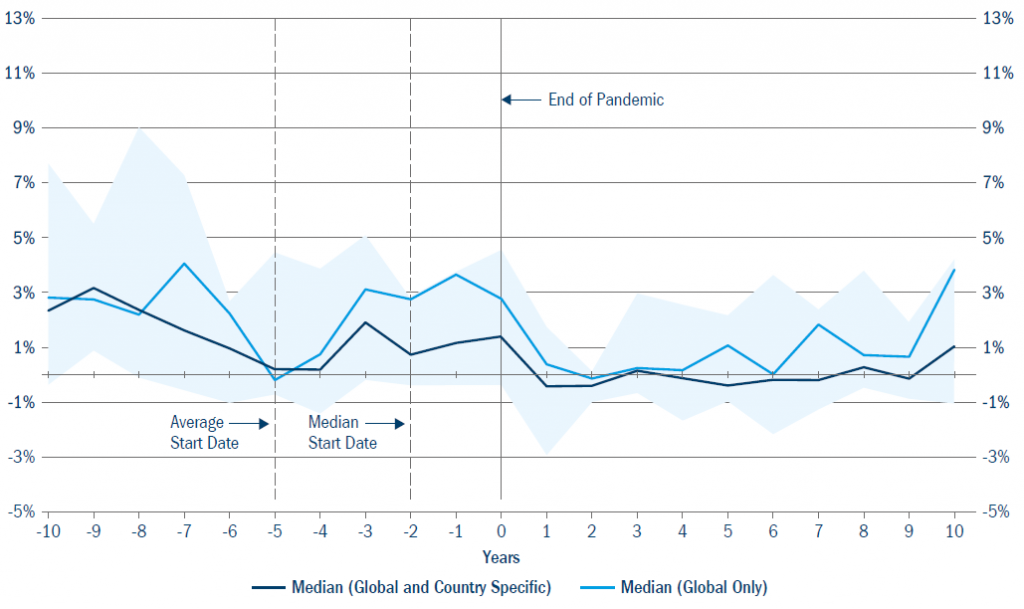

a natural consequence of pandemics”. Figure 1 below illustrates this. Depicting the median (and interquartile

range) behaviour of inflation across the 12 largest, mainly global, pandemics, from the Black Death of 1331-1353

to the Hong Kong Flu of 1968-1969, demonstrates that inflation has typically remained weak during pandemics

and declined in their aftermath – fluctuating close to zero for nine years after the pandemic has ended.

Figure 1: Inflation has typically remained weak in the aftermath of major pandemics

Notes: CPI Inflation (% year-on-year) around pandemics, median and interquartile range.

Source: Goldman Sachs Global Investment Research, Bank of England (2021), Schmelzing (2020).

Similarly, the study found that during pandemics, median nominal bond yields remained stable (at around 5.5%),

before declining in the years following the pandemic.

Could it be different this time?

Of course, accepting the limited data set and the seemingly obscure data points from which the study has

derived its conclusions (thankfully major pandemics do not occur with the same regularity as wars or financial

crises for that matter) and the fact that inflation and bond yields both started the pandemic from historically low

bases, this time it really could be different. Or could it?

While it is highly unlikely that the UK is about to return to the dark days of the mega inflation that characterised

the mid- to late-1970s, history also tells us that the most important determinant of the strength of an economic

recovery and its knock on effect to prices is, without exception, the depth and severity of the downturn that

preceded it.

However, notwithstanding the recent tick up in UK and US consumer price index (CPI) inflation, financial news and

data vendor, Bloomberg, is currently forecasting only a marginal uptick in US and Eurozone CPI inflation over the

next 12 months, with only slightly larger increases in the UK and Japan – all accompanied with commensurately

minor short-term projected rises in 10 year government bond yields.7 Additionally, little in the way of movement

in central bank policy rates is forecast – these being principally guided by central bank inflation, or price stability,

targets.8 Not that we should be surprised by this, given that policy rates are a highly ineffective tool to control

cost-push price inflation – that stemming from commodity and component shortages. Rather, policy rates target

signs of demand-pull inflation – demand outstripping what the economy is able to sustainably supply – in this

case the likely dramatic upturn in consumer spending financed by the considerable savings built up over the

past year.

Institutional investors, in taking their cue from reported inflation and a whole host of other economic data

and central bank soundings, are keeping a watchful eye on both demand pull and cost push inflation. This is

evidenced by the heightening of UK (and US) inflation expectations above central bank inflation targets on both a

two and 10 year timeframe.9 Despite this, in all probability, any uptick in inflation is likely to be a relatively short

lived phenomenon, given the long-run deflationary forces constantly bearing down on shorter-term inflationary

pressures. Think globalisation, the ever increasing utilisation of productivity enhancing new technology and AI,

demographic headwinds and the rise of the gig economy. Additionally, notwithstanding the widely anticipated

dramatic upturn in economic growth, there remains considerable slack in most economies’ productive capacity,10

while wage inflation, historically one of the key drivers of price inflation, is fast becoming a distant memory.

However, these long-run deflationary forces are potentially counterbalanced, to a degree, by medium-term

countervailing forces such as the stimulative investment spending flowing from the move to net zero emissions,

and the emergence of a new fiscal consensus, by governments, that focuses on the sustainability of debt service

costs, rather than shrinking ballooning budget deficits. In other words, there are plenty of uncertainties on the

horizon. Indeed, if there’s anything history has taught us it’s that whenever inflation starts to rear its head,

investors and central banks can never afford to be complacent. The 40th US President never had any doubts

about that.

Why does all of this matter?

Most defined benefit (DB) pension scheme benefits are directly or indirectly linked to one or a number of

measures of inflation, albeit typically capped at a predetermined level, and increasingly hedged, at least to the

funding level, as the latter improves. However, it goes without saying that when faced with index-linked liabilities,

of any magnitude, inflation should always be factored into the asset allocation decision. After all, it is real (or

inflation-adjusted), not nominal, asset returns that ultimately matter. Of course, most DB schemes are already

alert to this fact. Indeed, notwithstanding funding, covenant, liquidity and governance issues, diversification

into real assets, such as real estate and infrastructure, the latter typically offering secure, long-dated inflationplus

cash flows, has gained traction over the past decade given the long-term inflation matching qualities of

this heterogeneous asset class. Although equities are demonstrably the archetypal long-term inflation hedge,

principally as a result of the compounding effect of reinvested dividends and real long-term dividend growth,

for many private sector DB schemes the popularity of equities has waned, given the short-term volatility of the

asset class and its often disproportionate contribution to the scheme’s value at risk (VaR).

For Defined Contribution (DC) schemes, inflation is, of course, but one of the risks savers need to take into account when investing their contributions, especially those with a significant time horizon, as failure to do so will surreptitiously erode the real value, or purchasing power, of their pension pot. Equally, for those DC investors in decumulation taking advantage of freedom and choice, inflation is one of the three key risks (in addition to investment sequencing and longevity risk) that should be sidestepped. Indeed, even if inflation is just 1% greater than expected over, say, a 30 year retirement, this is enough to erode the real value of every pound to 65 pence. Therefore, in both accumulation and decumulation, selecting an investment strategy that targets a deliverable inflation-plus absolute return objective is a key requisite to laying the foundations for a good retirement outcome.