Summary

In the quarterly Columbia Threadneedle Investments LDI Survey we poll investment bank trading desks on the volumes of quarterly hedging transactions. As fears grew as to the non- transitory nature of inflation, exacerbated by the war in Ukraine and energy supply threats from Russia, all eyes turned to the central banks and their commitment to and speed of policy normalisation. Consequently, yields rose rapidly and meaningfully. For example, we saw an approximate 1.25% rise in 30-year gilt real yields. Inflation hedging activity remained consistent with the previous quarter, but interest rate hedging dropped by 13% quarter-on- quarter.

The second quarter of 2022 brought the relaxation of most COVID-19 restrictions around the world, a freedom that remained in place despite the prevalence of mass-spreader events such as festivals. However, even as we begin to accept and live with COVID-19 and its recent milder variants, the impact of lockdowns and supply chain snarl-ups has yet to be dealt with, particularly in the form of inflation. The war in Ukraine and its consequent impact on the global food and fertiliser supply has magnified the pressure on the supply side, further aggravated by Russia’s energy brinkmanship as they threaten to cut off supplies to various countries and demand payment in roubles. In the UK, concerns of a return to the 1970s, with strike action and entrenched inflation, drove policy makers to maintain their steady rate hiking path. There was speculation that the Bank of England Monetary Policy Committee’s June meeting could herald a 0.50% hike, given the strength of rhetoric from the US and Europe, yet despite dissension the rise was 0.25% taking the UK base rate to 1.25%. This compares to a 0.75% hike in the US in June bringing the Fed Rate to 1.75% and an historic 0.50% rate hike in the EU in July taking their Deposit Rate to 0.00%. However, as monetary tightening accelerates, so too does the spectre of recession, noting the difficulty of engineering a soft landing.

The change in market environment, as central banks tackle high inflation (the UK RPI change year-on-year reached 11.8% in June) and fiscal policy aims to deal with the cost-of- living crisis, has been sharp and severe. As yields have risen, this is a boon for underhedged pension funds as their liabilities will be falling more than their assets, thereby improving their funding ratio. Typically, this would prompt a call to lock in this benefit by increasing hedging, but this seems not to have been borne out in this recent quarter in significant size. The reason for this most likely relates to collateral and collateral availability. Over the previous decade, as yields have fallen and liabilities have risen, LDI mandates have kicked off cash to be redeployed in equities, credit and many other forms of growth assets. With yields rising more recently, the opposite has occurred as LDI mandates have called cash from investors. In this environment it is more challenging to release further capital to extend LDI hedging and lock in improved funding ratios. Indeed, it has been remarked upon that a significant amount of selling of hedging assets has been seen, indicating that some market participants are unable or unwilling to meet collateral requirements and have reduced their hedge as a result.

Total interest rate liability hedging activity fell to £26.1 billion, a decrease of 13% from the previous quarter, however inflation hedging remained largely the same at £29.4 billion. New hedging activity was relatively weak this quarter, bar in inflation where those with LPI hedges replaced them as inflation dropped back to levels seen at the end of 2020. Switching activity however was strong, driven by meaningful changes in relative value between gilts and swaps as the market digested each piece of news and, of course, buy-out activity.

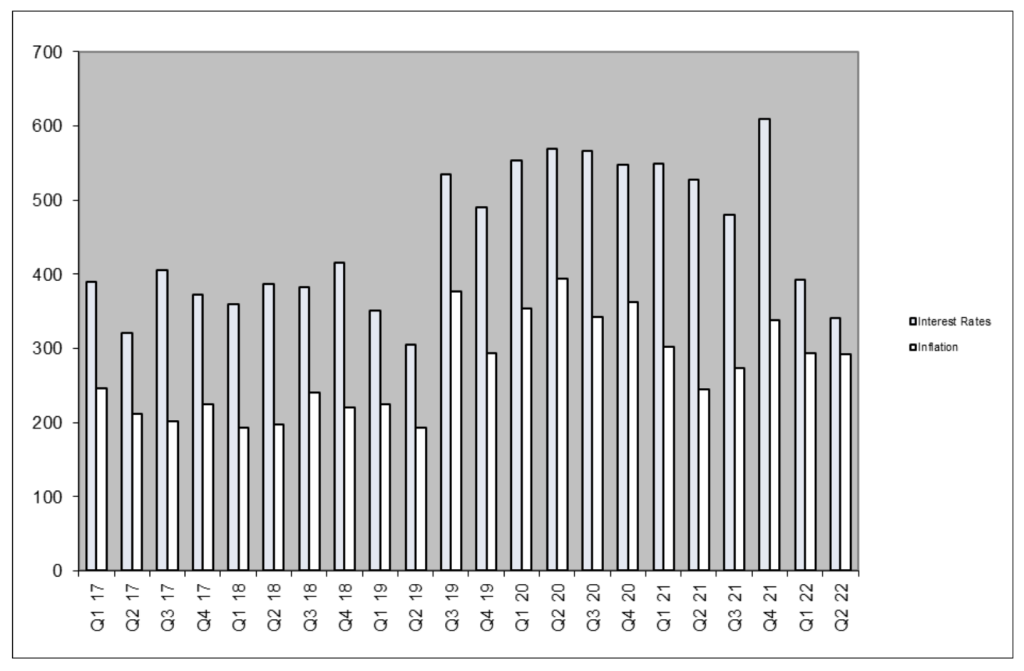

The chart below describes hedging transactions as an index based on risk. Note that transactions include switches from one hedging instrument into another. It should be noted that as the index is constructed by using the rate of change of risk traded by each counterparty per quarter, it allows the introduction of additional counterparties to the survey.

Chart 1: Index of UK pension liability hedging activity (based on £ per 0.01% change in interest rates or RPI inflation expectations i.e. in risk terms).

Source: Columbia Threadneedle Investments, as at 30th June 2022

The funding ratio index run by the Pension Protection Fund showed further improvement quarter-on- quarter (120.1% at end June vs 107.7% at end December), driven by rising real yields. As noted, this did not necessarily translate into more de-risking demand due to collateral sourcing requirements. However buy-out interest remains sky-high, also helped by the more attractive spreads in the high- quality corporate bond market, which are a component of insurance pricing.

Market Outlook

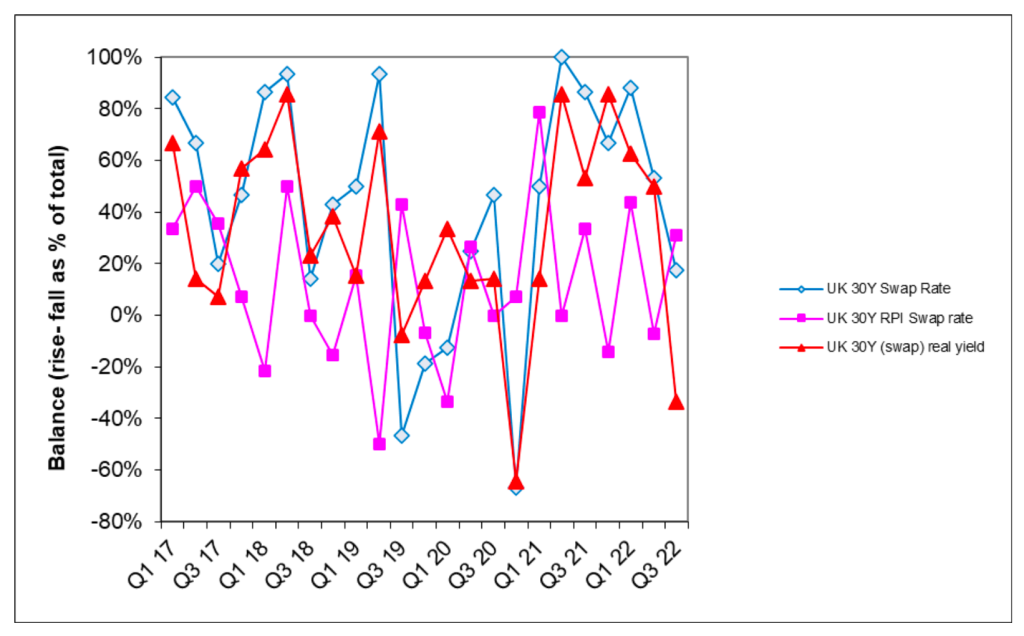

The Columbia Threadneedle Investments LDI Survey also asks investment bank derivatives trading desks for their opinions on the likely direction of key rates for pension scheme liability hedging. The aim is to get information from those closest to the market to aid trustees in their decision-making.

The results are shown below as the number of those predicting a rise less those predicting a fall, as a percentage of the number of responses. The larger the balance, the more responses predict a rise. The more negative the balance, the more responses predict a fall.

Chart 3: Change in swap rates over the next quarter.

Source: Columbia Threadneedle Investments. As at 30 June 2022

For the second quarter in a row, our counterparties’ group predictions have been accurate, although more through luck as they were almost evenly split on the outcome for inflation. Their expectations of monetary policy tightening were borne out and, with the drop in inflation, we saw a significant increase in real yields. The firm action by central banks served to temper longer term inflation expectations despite realised inflation increasingly coming under pressure from energy and other commodity sources.

For the third quarter of 2022, our counterparties predict a rise in inflation and a drop in real yields and have low conviction on a further rise in long term interest rates. Those banks anticipating a rise in inflation cite the strong labour market and the supply side nature of the inflationary pressures. It should be noted that the new energy cap is due in October and expectations of another leap, combined with energy insecurity into winter, could drive inflation up. Buyer demand for inflation hedging has been muted in the last few months. If this were to return, it would support long-term inflation pricing. On the other side, it was noted that long-dated RPI is still above pre-pandemic levels and too high once the transition to CPI-H is factored in from 2030. However, supply and demand dynamics may make it challenging for this fundamental pricing view to be realised. It may seem odd that our counterparties are not sure on the direction of travel for long term interest rates given that a schedule of rate hikes is expected, however the difference revolves around what is already priced-in. Current market pricing shows a peak of 3.25% in the UK base rate, attained in March 2023. However, many feel that this is too aggressive and in our poll of bank counterparties the terminal rate was viewed to be c. 2.50%, reached by the end of 2022. After this point, rates are expected to be kept on hold or even reduced depending on whether we see a soft landing or a more severe recession. Therefore, if reality does not match the schedule predicted by market pricing, longer dated interest rates could fall. Limited supply over the summer and poor economic data could also drive a fall in longer dated interest rates. Those counterparties who believe that rates have further to rise from here are focused on Quantitative Tightening (whereby the Bank of England starts selling its stock of gilts back to the market) of which we will learn more at the August MPC meeting, with a likely start in September.