Funds and prices

Significant fund changes

Important Information

Please read this important information regarding important changes we have made, or are planning to make to our fund range.

For details of significant events shown on Key Investor Information Documents (KIID), please refer to the below documents:

Significant Events related to Columbia Threadneedle (AM) Holdings PLC

Effective 12 December 2024, changes will be made to the investment policies of CT (Lux) Asia Equities and CT (Lux) Asian Equity Income to broaden the permitted regional exposure, beyond Asia, to include investment in companies in the wider Asia Pacific region or which have significant Asia Pacific business operations (excluding Japan).

Further information can be found here.

Effective 12 December 2024, the fund name will change to “CT (Lux) Pan European Focus” and the investment objective and policy will be amended.

While the fund will continue to invest in the shares of companies domiciled in Europe (including the UK), following the changes it will seek to achieve capital appreciation rather than income, through investment in a concentrated portfolio of equity securities.

The fund will also promote environmental and social characteristics by integrating a range of responsible investment measures into the investment decision-making process. The changes will result in the fund being categorised as Article 8 under SFDR.

Further information can be found here.

Funds in scope for the change(s):

- CT (Lux) Responsible Euro Corporate Bond Fund

- CT (Lux) Responsible Global Emerging Markets Equity Fund

- CT (Lux) Responsible Global Equity Fund

- CT Responsible Global Equity Fund

- CT Responsible Sterling Corporate Bond Fund

- CT Responsible UK Equity Fund

- CT Responsible UK Income Fund

- CT (Lux) SDG Engagement Global Equity

- CT (Lux) Sustainable Global Equity Enhanced Income Fund

- CT Sustainable Global Equity Income Fund

- CT (Lux) Sustainable Multi-Asset Income Fund

- CT (Lux) Sustainable Opportunities European Equity Fund

- CT Sustainable Opportunities Global Equity Fund

- CT Sustainable Universal MAP Range

Click here to learn more.

And for further information, please refer to the below documents.

CT (Lux) SDG Engagement Global Equity Fund - Investment Policy

CT (Lux) Sustainable Global Equity Enhanced Income Fund - Investment Policy

CT Sustainable Global Equity Income Fund - Investment Policy

CT (Lux) Sustainable Multi-Asset Income Fund - Investment Policy

CT (Lux) Sustainable Opportunities European Equity Fund - Investment Policy

CT Sustainable Opportunities Global Equity Fund - Investment Policy

Funds in scope for the changes:

• CT Responsible Global Equity Fund

• CT Responsible Sterling Corporate Bond Fund

• CT Responsible UK Equity Fund

• CT Responsible UK Income Fund

• CT (Lux) Responsible Euro Corporate Bond Fund

• CT (Lux) Responsible Global Emerging Markets Equity Fund

And for further information, please consult the below document:

Responsible Investment Strategies - Summary Criteria

The Board of Columbia Threadneedle (Lux) I has decided to introduce the possibility to (fully or partially) delegate investment management functions to certain entities of the Group without prior amendment of the Prospectus or notification to shareholders. Further information can be found here.

Effective 1 November 2024, we will amend the Investment Policy of the CT Asia Fund to broaden its regional exposure, to include investment in companies in the wider Asia Pacific region. We will also take the opportunity to change the name of the Fund to the ‘CT Asia Pacific Fund’ to reflect the Investment Policy changes. Please see the Shareholder Notification and Q&A for further details.

CT Asia Fund – Shareholder Notice of Policy Change

CT Asia Fund – Adviser Notice of Policy Change

CT Asia Fund – Q&A

The TPEN Index-Linked Bond Fund will close on 14 October 2024.

Notice of closure – Investor notice

Notice of closure – Q&A

The following funds (both sub-funds of Columbia Threadneedle Specialist Funds (UK) ICVC) will be closed on 8 October 2024:

CT Sterling Medium and Long-Dated Corporate Bond Fund

CT UK Index Linked Fund

Please see the Shareholder Notification and Q&A for further details.

Shareholder letter - CT Sterling Medium and Long-Dated Corporate Bond Fund

Shareholder letter - UK Index Linked Fund

Adviser letter - CT Sterling Medium and Long-Dated Corporate Bond Fund and CT UK Index Linked Fund

Q&A - CT Sterling Medium and Long-Dated Corporate Bond Fund and CT UK Index Linked Fund

Effective 2 September 2024, changes will be made to the investment management arrangements applicable to the following Columbia Threadneedle (Lux) I SICAV funds:

- CT (Lux) American Extended Alpha

- CT (Lux) American Select

- CT (Lux) American Smaller Companies

Further information can be found here.

Effective 2 September 2024, changes will be made to the Prospectus definition of “European smaller companies” which applies to the following Columbia Threadneedle (Lux) I SICAV funds:

- CT (Lux) European Smaller Companies

- CT (Lux) Pan European Smaller Companies

- CT (Lux) Pan European Small Cap Opportunities

Further information can be found here.

Effective 2 September 2024, changes will be made to the investment policies and SFDR RTS Annexes (pre-contractual disclosures) of the following Columbia Threadneedle (Lux) I SICAV funds:

- CT (Lux) American

- CT (Lux) American Select

- CT (Lux) American Smaller Companies

- CT (Lux) Asia Equities

- CT (Lux) European Corporate Bond

- CT (Lux) European High Yield Bond

- CT (Lux) European Select

- CT (Lux) Global Corporate Bond

- CT (Lux) Global Equity Income

- CT (Lux) Global Focus

- CT (Lux) Global Select

- CT (Lux) Japan Equities

- CT (Lux) Pan European ESG Equities

- CT (Lux) UK Equities

- CT (Lux) US Contrarian Core Equities

- CT (Lux) European Smaller Companies

- CT (Lux) Pan European Smaller Companies

- CT (Lux) Pan European Small Cap Opportunities

- CT (Lux) Global Smaller Companies

These funds already promote environmental and social characteristics by integrating a range of responsible investment measures into the investment decision-making process, as well as ensuring that the companies in which the funds invest follow good governance practices.

From the Effective Date, the investment manager responsible for the management of the funds will increase the minimum proportion that each fund commits to holding sustainable investments, as further detailed in the SFDR RTS Annexes. For some of the funds, this will be the first time such a commitment is being made. The funds will continue to be categorised as Article 8 under SFDR.

For CT (Lux) Global Smaller Companies, additional changes are also being made to highlight Columbia Threadneedle’s commitment to the Net Zero Asset Managers Initiative (NZAMI), which will now include this fund.

Further information can be found in the below. Please refer to the numbered fund list above for the corresponding letter.

Shareholder Letter (Funds 1-15)

Shareholder Letter (Funds 16-18)

Shareholder Letter (Fund 19)

The TPEN UK Equity High Alpha Fund will close on 8 October 2024.

The following funds* (all sub-funds of Columbia Threadneedle (Lux) III) will be closed on 12/06/2024:

- CT (Lux) European Smaller Cap - Shareholder Notice

- CT (Lux) Global Smaller Cap Equity - Shareholder Notice

- CT (Lux) US Smaller Companies - Shareholder Notice

*these three Funds are not to be confused with CT (Lux) Global Smaller Companies, CT (Lux) European Smaller Companies and CT (Lux) American Smaller Companies Funds, which are unimpacted by this announcement.

We are making a change to the investment universe of the TPEN Property Fund, to allow investment in professionally managed residential assets, effective from 1 August 2024. Please see the TPEN Investor Notification and KFD (effective August 2024).

We will be making changes to the following funds (“Funds”):

• CT MM Navigator Distribution Fund

• CT MM Navigator Cautious Fund

• CT MM Navigator Balanced Fund

• CT MM Navigator Growth Fund

• CT MM Navigator Boutiques Fund

From 1 July 2024 – Change to investment objectives: Changing each Funds’ investment objective to include a performance target benchmark (composite indices).

From 14 June 2024 – ‘A’ share class conversions: All ‘A’ share class holders of the Funds will be converted to the lower fee ‘C’ share class of the Funds.

Please refer to the relevant Q&A’s for further information on the changes to investment objectives and the conversions.

Investor notice – changes to investment objectives

Investor notice – changes to investment objectives and ‘A’ share class conversions

Q&A – changes to investment objectives

Q&A – ‘A’ share class conversions

The CT UK Smaller Cap Fund (a sub-fund of Columbia Threadneedle (UK) ICVC II) will close on 13 June 2024.

Notice of closure - CT UK Smaller Cap Fund - Shareholder

Notice of closure - CT UK Smaller Cap Fund - Adviser

The CT Diversified Monthly Income Fund and CT Multi-Manager Investment Trust Fund (a sub-fund of Columbia Threadneedle (UK) ICVC III) will close on 20 May 2024.

Notice of closure - CT Diversified Monthly Income Fund - Unitholder

Notice of closure - CT Diversified Monthly Income Fund - Adviser

Notice of closure - CT Multi Manager Investment Trust Fund - Shareholder

Notice of closure - CT Multi Manager Investment Trust Fund - Adviser

The following funds (all sub funds of Columbia Threadneedle (UK) X) will have changes made to them on 3 May 2024.

Notice of change - CT Overseas Equity-Linked UK Gilt Fund

Notice of change - CT Overseas Equity-Linked UK Inflation Fund

The following funds (all sub funds of Columbia Threadneedle (UK) X) will be closed on 3 May 2024.

The CT Multi-Sector Bond Fund and the CT Multi-Sector Higher Income Bond Fund (sub-funds of Columbia Threadneedle (UK) ICVC I) will close on 24 April 2024.

Notice of closure – CT Multi-Sector Bond Fund - Shareholder

Notice of closure – CT Multi-Sector Higher Income Bond Fund - Shareholder

Notice of closure – CT Multi-Sector Bond Fund - Adviser

Notice of closure – CT Multi-Sector Higher Income Bond Fund - Adviser

The transition of third-party administrative services to SS&C Financial Services Europe Limited for TPEN will be effective from 4 March 2024. Please see the third client notification and the new Dealing Form.

At an EGM of shareholders held on 31 January 2024, the resolution put forward to merge the CT UK Equity Opportunities Fund ("Merging Fund") into the CT Growth and Income Fund ("Receiving Fund") was passed. Accordingly, the merger will take place on 1 March 2024 with the first day of dealing in New Shares in the Receiving Fund to commence on 4 March 2024.

Details of the Merging and Receiving share classes are below.

| Merging Share class Name | Merging ISIN | Receiving Share class Name | Receiving ISIN |

|---|---|---|---|

| CT UK Equity Opportunities Fund 2 Inc | GB0001451722 | CT UK Growth and Income Fund 2 Inc | GB0001647246 |

| CT UK Equity Opportunities Fund 2 Acc | GB00BD2BT151 | CT UK Growth and Income Fund Z Acc | GB00BYQFJZ49 |

| CT UK Equity Opportunities Fund Z Inc | GB00B9BQ0321 | CT UK Growth and Income Fund Z Inc | GB00B8848T44 |

The transition of third-party administrative services to SS&C Financial Services Europe Limited for TPEN will be effective from 4 March 2024. Please see the second client notification and Q&A for further details.

TPEN Investor Notification

Q&A

Contact details flyer

KFD

Guest Fund KFD

Columbia Threadneedle Investments is proposing to merge the CT UK Equity Opportunities Fund into the CT UK Growth and Income Fund. Both are sub-funds of Columbia Threadneedle Investment Funds (UK) ICVC, an open-ended investment company (OEIC), managed by us. All shareholders in the Merging Fund will have the opportunity to vote on the proposed merger. Please see the below documents for further details.

The CT Institutional Sterling Corporate Bond Fund, a sub-fund of the Columbia Threadneedle (UK) ICVC IV (“the Company”), will close on 15 January 2024. The Company will be closed at the same time.

The following funds (all sub-funds of Columbia Threadneedle Specialist Funds (UK) ICVC) will be closed on 26/01/2024:

CT American Extended Alpha Fund

CT China Opportunities Fund

CT UK Extended Alpha Fund

Please see the Shareholder Notification and Q&A for further details.

CT American Extended Alpha Fund - Shareholder notice of closure

CT China Opportunities Fund - Shareholder notice of closure

Effective 29 December, the benchmark on the CT (Lux) SDG Engagement Global Equity Fund will change from the MSCI ACWI SMID Cap Index to the MSCI ACWI Mid Cap Index.

Further information can be found here.

The Board of Columbia Threadneedle (Lux) III has decided to introduce the possibility to (fully or partially) delegate investment management functions to certain entities of the Group without prior amendment of the Prospectus or notification to shareholders. Further information can be found here.

We are notifying you of a change of provider of third-party administration services for TPEN. Please refer to the ‘TPEN Investor Notification’ providing 3 months’ notice of this change. Further information will be provided closer to the effective date.

Effective 20 November, changes will be made to the investment policies and SFDR RTS Annexes (pre-contractual disclosures) of the following Threadneedle (Lux) and Columbia Threadneedle (Lux) sub-funds:

- Threadneedle (Lux) Asia Equities

- Threadneedle (Lux) European Select

- Threadneedle (Lux) European Smaller Companies

- Threadneedle (Lux) Global Equity Income

- Threadneedle (Lux) Global Focus

- Threadneedle (Lux) Global Select

- Threadneedle (Lux) Pan European Smaller Companies

- Threadneedle (Lux) European High Yield Bond

- Threadneedle (Lux) American Smaller Companies

- Threadneedle (Lux) Global Smaller Companies

- Threadneedle (Lux) American

- Threadneedle (Lux) American Select

- Threadneedle (Lux) Pan European Small Cap Opportunities

- Threadneedle (Lux) UK Equities

- Threadneedle (Lux) European Corporate Bond

- Threadneedle (Lux) Global Corporate Bond

- Threadneedle (Lux) US Contrarian Core Equities

- Threadneedle (Lux) Global Emerging Market Equities

- Threadneedle (Lux) Pan European ESG Equities

- Threadneedle (Lux) European Social Bond

- Columbia Threadneedle (Lux) Sustainable Outcomes Global Equity

For Funds 1-10 (as numbered above), the investment policies and SFDR RTS Annexes will be amended to introduce additional measures that support the promotion of environmental and social characteristics. The Funds will continue to be categorised as Article 8 under SFDR. For Funds 1-8, additional changes are also being made to highlight Columbia Threadneedle’s commitment to the Net Zero Asset Managers Initiative (NZAMI), which includes these Funds.

For Funds 11-18 (as numbered above), the investment policies will be amended and new SFDR RTS Annexes included to introduce the promotion of environmental and social characteristics. The changes will result in the Funds being categorised as Article 8 under SFDR. For Funds 11-16, additional changes are also being made to highlight Columbia Threadneedle’s commitment to the Net Zero Asset Managers Initiative (NZAMI), which includes these Funds.

For Threadneedle (Lux) Pan European ESG Equities, the investment policy and SFDR RTS Annex will be amended to provide additional clarity and information on the various responsible investment measures that are embedded into the existing investment decision-making process and to introduce additional measures that support the promotion of environmental and social characteristics. The Fund will continue to be categorised as Article 8 under SFDR. Additional changes are also being made to highlight Columbia Threadneedle’s commitment to the Net Zero Asset Managers Initiative (NZAMI), which includes this Fund.

For Threadneedle (Lux) European Social Bond and Columbia Threadneedle (Lux) Sustainable Outcomes Global Equity, the investment policies and SFDR RTS Annexes will be amended to allow the Funds to be re-categorised from Article 8 to Article 9 under SFDR. Additional changes are also being made to highlight Columbia Threadneedle’s commitment to the Net Zero Asset Managers Initiative (NZAMI), which includes these Funds.

Further information can be found in the below. Please refer to the numbered fund list above for the corresponding letter.

Shareholder Letter (Funds 1-8)

Shareholder Letter (Funds 9-10)

Shareholder Letter (Funds 11-16)

Shareholder Letter (Funds 17-18)

Shareholder Letter (Fund 19)

Shareholder Letter (Fund 20)

Shareholder Letter (Fund 21)

Update

The proposals to change two of our SICAV company umbrella names, as well as their underlying fund names, were passed at Extraordinary General Meetings held on 27th September. These name changes will take effect on 20th November 2023.

In 2021 Columbia Threadneedle Investments acquired BMO’s asset management business in EMEA (Europe, Middle East and Africa), resulting in the renaming of various funds and entities within the combined business to reflect a unified Columbia Threadneedle Investments brand in July 2022. A reminder of the changes to the names of our UK-domiciled funds can be seen here.

Renaming the Companies

Consistent with these changes, the Boards of Columbia Threadneedle (Lux) and Threadneedle (Lux) propose to amend and restate the Companies’ articles of incorporation (the “Articles”) to change the names of the two Companies as follows:

|

Existing Umbrella Name

|

New Umbrella Name

|

|---|---|

|

Columbia Threadneedle (Lux)

|

Columbia Threadneedle (Lux) II

|

|

Threadneedle (Lux)

|

Columbia Threadneedle (Lux) I

|

Renaming the sub funds

In addition to renaming the Companies, the Boards propose to change the name of the underlying funds in these umbrellas by replacing the pre-fix “Columbia Threadneedle (Lux)” with “CT(Lux)” and by replacing the pre-fix “Threadneedle (Lux)” with “CT (Lux)”, with effect from 20 November 2023, as described in Appendix 1 of the letters below. This will better align the fund names with the Columbia Threadneedle Investments brand. The renaming of the funds will not affect the way in which they are managed or their investment objectives and policies.

A draft of the restated Articles showing the relevant changes is available to shareholders free of charge at the Company’s registered office.

Please follow this link to see all the proposed changes.

Effective 18 October, the benchmark on the Threadneedle (Lux) Global Technology sub-fund will change from the MSCI World Information Technology Index to the MSCI World Information Technology 10/40 Index.

Further information can be found below.

From 2 October 2023, changes will be made to the investment policies of the following funds:

- CT American Smaller Companies Fund (US)

- CT Asia Fund

- CT Global Emerging Markets Equity Fund

- CT American Fund

- CT American Select Fund

- CT European Select

- CT European Smaller Companies Fund

- CT Global Equity Income Fund

- CT Global Focus Fund

- CT Global Select Fund

- CT UK Fund

- CT UK Sustainable Equity Fund

In summary, the investment policies of these funds will be amended to integrate certain RI measures into the decision-making process and/or highlight Columbia Threadneedle’s commitment to the Net Zero Asset Managers Initiative (NZAMI).

Further information can be found below:

Investment Policy Changes: ESG-related (Funds 1-3) – Adviser Letter

Investment Policy Changes: ESG-related (Funds 1-3) – Shareholder Letter

Investment Policy Changes: ESG-related and NZAMI (Funds 4-11) – Adviser Letter

Investment Policy Changes: ESG-related and NZAMI (Funds 4-11) – Shareholder Letter

Investment Policy Changes: NZAMI (CT UK Sustainable Equity Fund) – Adviser Letter

Investment Policy Changes: NZAMI (CT UK Sustainable Equity Fund) – Shareholder Letter

Effective 2 October 2023, the way liquidity is managed in the CT UK Property Authorised Investment Fund and CT UK Property Authorised Trust (its feeder fund) is being changed, to allow the normal level of cash exposure to rise beyond 15%, to 15-25% (in normal circumstances).

CT UK Property Authorised Investment Fund – Shareholders

CT UK Property Authorised Investment Fund – Advisers

CT UK Property Authorised Trust – Unitholders

The CT Asia Pacific Equity Fund (sub-fund of Columbia Threadneedle (UK) ICVC II) will be closed on 21/09/2023

We are notifying you of some changes that we are making to our CT European Smaller Companies Fund. The Fund’s investment objective and policy is being amended on 31 July 2023 to reflect the change of benchmark index from the EMIX Smaller European Companies Ex UK Index to the MSCI Europe ex UK Small Cap Index. In addition, we are also taking this opportunity to define the time period over which the Fund aims to achieve its investment objective of capital growth.

From 1 June 2023, changes will be made to the investment objectives and policies of the following funds:

- CT Sterling Short-Dated Corporate Bond Fund

- CT Sterling Corporate Bond Fund

- CT Sterling Medium and Long-Dated Corporate Bond Fund

In summary, the changes are as follows:

- The existing benchmark for the CT Sterling Short-Dated Corporate Bond Fund will be replaced by the iBoxx GBP Corporates 1-5 Index.

- The iBoxx GBP Non-Gilts Index will be introduced as the formal benchmark of the CT Sterling Corporate Bond Fund.

- The Funds’ investment policies will be updated to integrate certain RI measures into the investment decision-making process.

Further information can be found below:

Columbia Threadneedle will lift the temporary dealing suspension on the CT UK Property Authorised Investment Fund (CT UK PAIF) and its feeder fund, CT UK Property Authorised Trust with effect from 12.01 on 28 February 2023. This means that the first valuation for dealing will be Wednesday 1 March 2023. Find out more

We carry out regular reviews of the range of funds offered by Columbia Threadneedle Investments to ensure that we are delivering value to shareholders.

As a result, we are transferring some retail investors’ holdings into an alternative share class which is in the same fund but has a lower Annual Management Charge (AMC) and lower Ongoing Charges Figure (OCF).

A copy of the letter and a list of funds and share classes affected can be found here.

We are notifying you of some changes that we are making to our TPEN Property Fund. Please refer to the ‘TPEN Investor Notification’, providing 3 months’ notice of these changes. For more information, please refer to the ‘TPEN Property Fund Q&A’ and corresponding Key Features Document (KFD), which will be effective from May 2023.

Following the recent transition to Columbia Threadneedle, we are taking the opportunity to make additional changes to the names of the Funds. The new names reflect more closely the nature of the Funds’ investments, while ensuring that there is sufficient differentiation from the names of other Columbia Threadneedle funds.

On 27 January 2023, the CT Select UK Equity Fund was merged into the CT Responsible UK Equity Fund. The merger was approved by shareholders at an EGM held on 18 November 2022. Details of the Merging and Receiving share classes are below.

| Merging Shareclass Name | Merging ISIN | Receiving Shareclass Name | Receiving ISIN |

|---|---|---|---|

| CT Select UK Equity 1 Acc | GB0008463894 | CT Responsible UK Equity 1 Acc | GB0030833981 |

| CT Select UK Equity 2 Acc | GB0008464314 | CT Responsible UK Equity 2 Acc | GB0033396481 |

| CT Select UK Equity 4 Acc | GB00B5463658 | CT Responsible UK Equity 4 Acc | GB00B7KL2G13 |

| CT Select UK Equity L Acc | GB00BM9GGX75 | CT Responsible UK Equity L Acc | GB00BMY8FB96 |

The CT UK Mid-Cap Fund (sub-fund of Columbia Threadneedle (UK) ICVC I) closed on 08/11/2022

The investment objective and policy of the following funds changed to make them clearer and more meaningful for shareholders. Updated wording can be found in the Prospectus:

CT Responsible Global Equity Fund (a sub-fund of Columbia Threadneedle (UK) ICVC V) - Prospectus

CT UK Equity Income Fund (a sub-fund of Columbia Threadneedle (UK) ICVC V) - Prospectus

CT Responsible UK Equity Fund (a sub-fund of Columbia Threadneedle (UK) ICVC V) - Prospectus

CT Sustainable Opportunities Global Equity Fund (a sub-fund of Columbia Threadneedle (UK) ICVC I) - Prospectus

The CT Responsible China A-Share Equity Fund (sub-fund of Columbia Threadneedle (Irl) II PLC) closed on 19/10/2022

Columbia Threadneedle Investments has suspended dealing in the CT UK Property Authorised Investment Fund and its feeder fund, the CT UK Property Authorised Trust from 12 noon on 10 October 2022.

CT Corporate Bond Fund (sub-fund of Columbia Threadneedle (UK) ICVC II) closed on 05/10/22

The CT Emerging Markets Equity Fund (sub-fund of Columbia Threadneedle (UK) ICVC II) closed on 05/10/22

The CT European Real Estate Securities Fund (sub-fund of Columbia Threadneedle (Irl) III PLC) changed its bench from FTSE EPRA NAREIT Developed Europe Capped Index to FTSE EPRA Nareit Developed Europe UCITS Capped Net Tax Index

The CT Long Dated Sterling Corporate Bond Fund (sub-fund of Columbia Threadneedle (UK) ICVC IV) closed on 22/09/2022

The CT Enhanced Income UK Equity Fund (sub-fund of Columbia Threadneedle (UK) ICVC I) closed on 22/09/2022

The CT Enhanced Income Euro Equity Fund (sub-fund of Columbia Threadneedle (Irl) III PLC) closed on 06/09/2022

In July 2022, we are changing the names of our UK fund umbrella companies and their sub-funds to align them more closely with our global brand name, Columbia Threadneedle Investments.

New subscriptions into Class D Shares of our OEIC funds are no longer accepted as the share class will close on 2 September 2022. Regular savings and top ups are permitted until the closure of the share class.

Following the UK’s departure from the European Union (EU), our UK domiciled funds are no longer marketed in EU countries. As a result, Columbia Threadneedle Investments will no longer provide translations into EU languages of fund documents and marketing materials for sub-funds of Threadneedle Investment Funds ICVC and Threadneedle Specialist Investment funds ICVC (the “Funds”) and they will be withdrawn from our EU websites. These documents include Key Investor Information Documents (KIIDs), factsheets and prospectuses. The changes are effective from 4 July 2022.

At an EGM of shareholders held on 20 October 2021, the resolution put forward to merge the Threadneedle UK Select fund into the Threadneedle UK Fund (as detailed in the circular sent to shareholders on 20 September 2021) was passed. Accordingly, the merger will take place on 19 November 2021.

We are delighted to announce the launch of three income share classes on the TPEN Property fund. This is in addition to the accumulation units currently offered through the fund, and is in response to client demand as DB schemes reach full funding/maturity and begin to distribute income to underlying pension fund holders. The new income share classes will offer asset allocation flexibility and will complement Columbia Threadneedle Investment’s UK property investment philosophy of positioning funds with a focus on income, which we believe is the greatest contributor to total returns and the source of relative outperformance.

Columbia Threadneedle Investments is proposing to merge the Threadneedle UK Select Fund into the Threadneedle UK Fund. Both are sub-funds of Threadneedle Investment Funds ICVC, an open-ended investment company (OEIC), managed by us. All shareholders in this fund will have the opportunity to vote on the proposed merger. Please see the below documents for further details.

Following the transfer of assets from the Threadneedle Managed Funds into equivalent new sub-funds within the Threadneedle Opportunity Investment Funds ICVC, we would like to confirm that the funds were closed on 14 May 2021. Consequently, a final report relating to each fund has been prepared and is available below.

Threadneedle Managed Equity Income Fund - Final report and audited financial statements

Threadneedle Managed Funds - Final report and audited financial statements

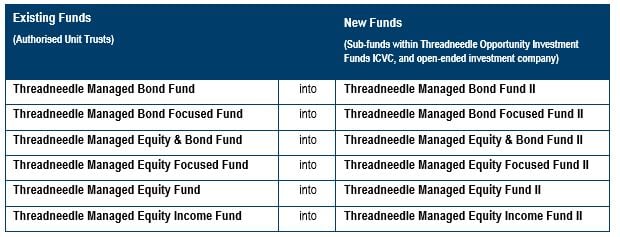

At a series of EGMs of unitholders held on 10 March 2021, the resolutions put forward to merge the Existing Funds with the New Funds (as detailed in the circular sent to unitholders on 11 February 2021) were passed. Accordingly, the mergers (summarised below) will take place on 9 April 2021, with dealing in the New Funds to commence on 12 April 2021.

NB: The designation “II” will be removed from the name of the New Funds from the effective date of the merger.

Columbia Threadneedle Investments is proposing to merge the Threadneedle Managed Funds range into New Funds within the Threadneedle Opportunity Investment Funds ICVC, an open-ended investment company (OEIC), managed by us. All unitholders in these funds will have the opportunity to vote on the proposed mergers. Please see the below documents for further details.

With effect from 3rd May 2021, the investment objectives of the TPEN Global Select and TPEN Multi Asset Fund will change. Please see the notification and Q&A for further details.

At Columbia Threadneedle Investments, we regularly review our fund range to ensure that our product offering remains suitable for our clients and our business. Following the latest review of the TPEN Fund Range, we wish to inform you of plans to close the Asia Equity, European Equity, Japanese Equity and North American Equity Funds at the end of April 2021.

As the UK has now left the European Union, UK funds managed by a UK manager will no longer qualify as UCITS funds under this framework. UK-based funds do however continue to follow all of the same rules as UCITS funds. We have put together a Q&A document to help you with this transition affecting OEIC funds from the 1 January 2021.

With effect from 1 May 2021 (the “Effective Date”), the Fund’s investment objective (performance target) will change from seeking to provide income returns broadly in line with the 1-month GBP LIBID1 (before charges), to seeking to provide income returns broadly in line with the 1-month compounded SONIA2 rate (before charges). Please see the notification and Q&A for further details.

1 London Interbank Bid Rate

2 Sterling Overnight Index Average

Following a review of the Threadneedle UK Absolute Alpha Fund, we have decided to close the Fund. The Fund has seen a significant reduction in size in recent times and we see little prospect of growth for it in the future. We believe the closure is in the best interests of investors. To this end, we will be closing the Fund on the 15 January 2021 (the Effective Date) and dealing in the Fund will be suspended from 12.01pm on 12 January 2021. Please see the Shareholder Notification and Q&A for further details.

At Columbia Threadneedle Investments, we regularly review our fund range to ensure that our product offering remains suitable for our clients and our business. Following the latest review of the TPEN Fund Range, we wish to inform you of plans to close these funds at the end of January 2021.

Columbia Threadneedle Investments is proposing to close the Threadneedle UK Absolute Alpha Fund. This is subject to approval by the fund’s regulator, the FCA.

We constantly review our range of funds and are committed to offering investors the best possible opportunities and value. Following a recent review, we are proposing to close this Fund due to a significant fall in the Fund’s assets and expected further redemptions. We believe that this is in the best interest of investors.

If the proposed closure is approved, we will be writing to all investors to notify them of the closure and the options available to them.

Important information about the Threadneedle Property Unit Trust (TPUT) and the Threadneedle Property Unit Trust Luxembourg Feeder SA SICAV-SIF (“The Fund”).

Notice of reopening for dealing

Columbia Threadneedle is pleased to announce that it will lift the temporary dealing suspension on the Threadneedle Property Unit Trust (TPUT) and the Threadneedle Property Unit Trust Luxembourg Feeder SA SICAV-SIF (“the Feeder Fund”) with effect from 30 September 2020.

Dealing in the Threadneedle Property Unit Trust and its Feeder Fund was suspended in March this year, following the deployment of a ‘material uncertainty clause’ by the Fund’s independent property valuer, CBRE. This meant that the valuer was unable to provide an appropriate level of certainty regarding the valuation of the Fund’s assets, due to the market environment at the time. The decision to suspend dealing in the Fund was aimed at preventing any unitholders being disadvantaged by those redeeming from or investing in the Fund at an uncertain price and was consistent with the approach taken across the investment industry.

On 9 September 2020, CBRE confirmed that it has removed the material uncertainty clause from the property assets held by the Fund. As a result, the Threadneedle TPEN Property Fund will reopen for dealing on 17 September.

We have been notified, by the valuer, that it has now removed the material uncertainty clause from the property assets held by the Fund from 9 September 2020. As a result, Fund’s dealing suspension will be lifted from 30 September 2020 which is the next dealing date.

This decision has been taken by the Manager of TPUT and Feeder Fund Board in consultation with the respective Trustee and Depositary. The Jersey Financial Services Commission (JFSC) and Commission de Surveillance du Secteur Financier (CSSF) has been informed.

We thank our clients for their understanding during this unprecedented time

Important information about the TPEN Property Fund (“The Fund”).

Notice of reopening for dealing

Columbia Threadneedle is pleased to announce that it will lift the temporary dealing suspension on the Threadneedle Pensions (TPEN) Property Fund with effect from the valuation point on 17 September 2020.

Dealing in the Threadneedle TPEN Property Fund was suspended on 20 March this year, following the deployment of a ‘material uncertainty clause’ by our independent property valuer, CBRE. This meant that the valuer was unable to provide an appropriate level of certainty regarding the valuation of the Fund’s assets, due to the market environment at the time. The decision to suspend dealing in the Fund was aimed at preventing any policyholders being disadvantaged by those redeeming from or investing in the Fund at an uncertain price and was consistent with the approach taken across the investment industry.

On 9 September 2020, CBRE confirmed that it has removed the material uncertainty clause from the property assets held by the Fund. As a result, the Threadneedle TPEN Property Fund will reopen for dealing on 17 September.

This decision has been taken by the TPEN Board.

Threadneedle TPEN Property Fund invests directly in UK commercial property. We continue to believe property should form part of a balanced portfolio for a long-term investor. The asset class can help provide portfolio diversification as well as reducing overall portfolio volatility.

We thank our clients for their understanding during this unprecedented time.

Notice of fund reopening for dealing.

Important information about the Threadneedle UK Property Authorised Investment Fund (Threadneedle PAIF) and its feeder fund, Threadneedle UK Property Authorised Trust (Feeder Fund) (together “The Fund”).

There have been a number of recent changes to our UK Property Fund range which impact new and existing investors as outlined below.

Columbia Threadneedle is pleased to announce that it will lift the temporary dealing suspension on the Threadneedle UK Property Authorised Investment Fund (Threadneedle PAIF) and its Feeder Fund, the Threadneedle UK Property Authorised Trust (together ‘the Fund’) with effect from the valuation point on 17 September 2020.

Dealing in the Threadneedle PAIF was temporarily suspended on 18 March 2020 following the deployment of a ‘material uncertainty clause’ by the Fund’s independent property valuer, CBRE. This meant the valuer was unable to provide an appropriate level of certainty regarding the valuation of the Fund’s assets in the market environment at the time. The decision to suspend dealing in the Fund was aimed at preventing any unitholders being disadvantaged by those redeeming from or investing in the Fund at an uncertain price and was consistent with the approach taken across the investment industry.

On 9 September 2020, CBRE confirmed that it has removed the material uncertainty clause from the property assets held by the Fund. As a result the Threadneedle PAIF will reopen for dealing on 17 September.

This action has been taken with the agreement of Citibank Europe Plc, UK Branch, the depositary of both funds, and the FCA has been notified.

Gerry Frewin, fund manager of the Threadneedle UK Property Authorised Investment Fund, said

“We are delighted to re-open dealing in the Fund from 17 September 2020. We appreciate that suspending dealings in the Fund may have caused some inconvenience for our clients, however the decision to suspend dealing meant that no unitholders would be disadvantaged and ensured the fair treatment of all investors. We thank our clients for their understanding during this unprecedented time.”

The Threadneedle PAIF and its Feeder Fund invest in physical UK commercial property such as warehouses, offices and retail around the UK. Columbia Threadneedle continues to believe real estate should form a part of a balanced portfolio for a long-term investor.

Notice of reopening for dealing

The temporary suspension on the Carbon Neutral Real Estate Fund (incorporating the Carbon Neutral Real Estate LP and Threadneedle Carbon Neutral RE Trust collectively “the Fund”) will be lifted with effect from the valuation point on 31 August 2020. This decision follows the announcement from the Fund’s independent valuer, JLL, confirming that the material uncertainty clause in respect of the Offices sector was lifted with effect from 07 August 2020.

The decision has been taken by Threadneedle Portfolio Services Limited as manager of the LP (following consultation with the General Partner and Depositary) and Threadneedle Investments (Channel Islands) Limited as manager of the Trust (following consultation with the trustee). The Jersey Financial Services Commission (JFSC) has been informed.

Columbia Threadneedle aims to ensure the fair treatment of all investors in our funds, whether they are transacting now or investing for the longer term.

Sandy Wilson, Fund Manager for the Carbon Neutral Real Estate Fund, said: “We are delighted to re-open the Fund with effect from 31st August 2020. We appreciate that suspending dealings in the Fund may have caused some inconvenience for our clients, however the decision to suspend meant that no unitholders would be disadvantaged and ensured the fair treatment of all investors.”

Carbon Neutral Real Estate Fund invests directly in UK commercial property. We continue to believe property should form a part of a balanced portfolio for a long-term investor.

We thank our clients for their understanding during this unprecedented time.

Important information about the Threadneedle Property Unit Trust Luxembourg Feeder SA SICAV-SIF (“the Fund”).

To protect the interests of investors in the Fund, Columbia Threadneedle Investments has temporarily suspended calculation of the Net Asset Value and dealing in Threadneedle Property Unit Trust Luxembourg Feeder SA SICAV SIF (“the Fund”) with effect from 24 March 2020. This means shareholders are temporarily unable to buy or sell units in the Fund. Any requests to transact received following suspension coming in to effect will not been actioned and will not be accepted or queued. This decision has been taken by the Fund Board in consultation with the AIFM and Depositary. The Commission de Surveillance du Secteur Financier (CSSF) has been informed.

Columbia Threadneedle aims to ensure the fair treatment of all investors in our funds, whether they are transacting now or investing for the longer term.

Threadneedle Property Unit Trust Luxembourg Feeder SA SICAV SIF has been suspended due to the fact that calculation of the Net Asset Value and dealing has been suspended in Threadneedle Property Unit Trust (the “Master Fund”). The Fund is a feeder fund in to the Master Fund, which suspended on 24 March following its independent property valuer, CBRE, deploying a ‘market uncertainty clause’, which means that they are unable to provide an appropriate level of certainty regarding the valuation of the Master Fund’s assets in the current exceptional market environment. This is consistent with the approach being taken across the broader industry. In response, we have suspended Threadneedle Property Unit Trust Luxembourg Feeder SA SICAV SIF until such time that a more certain valuation can be ascertained.

The situation is being closely monitored and the decision to suspend will be reviewed regularly.

Arnold Spruit, Chairman of the Board of Directors, said: “We appreciate that suspending Threadneedle Property Unit Trust Luxembourg Feeder SA SICAV SIF may cause some inconvenience for our clients. However, our objective is to protect the interests of investors in the Fund by ensuring the fair treatment of all, whether they are transacting now or investing for the longer term. Our decision to suspend dealing will prevent any shareholders being disadvantaged as a result of those redeeming from the Fund or newly investing in it at an uncertain price. We believe this is an appropriate measure to take to manage the Fund during this period of exceptional uncertainty and we are committed to reviewing our decision regularly.”

Threadneedle Property Unit Trust Luxembourg Feeder SA SICAV SIF indirectly invests in physical UK commercial property. We continue to believe property should form a part of a balanced portfolio for a long-term investor.

We thank our clients for their understanding and patience and will keep them informed via our website www.columbiathreadneedle.com/changes.

Important information about the Low-Carbon Workplace (LCW) Fund

To protect the interests of investors in the Fund, Columbia Threadneedle Investments has temporarily suspended dealing in the Low-Carbon Workplace LP and Threadneedle Low-Carbon Workplace Trust collectively (“the Fund”) with effect from 2pm on 24 March 2020. This decision has been taken by Threadneedle Portfolio Services Limited as manager of the LP (following consultation with the General Partner) and Threadneedle Investments (Channel Islands) Limited as manager of the Trust (following consultation with the trustee). The Jersey Financial Services Commission (JFSC) and the Financial Conduct Authority (FCA) have been informed.

Columbia Threadneedle aims to ensure the fair treatment of all investors in our funds, whether they are transacting now or investing for the longer term.

The Fund has been suspended due to the fact that our independent property valuer, JLL, has deployed a ‘market uncertainty clause’, which means that they are unable to provide an appropriate level of certainty regarding the valuation of the Fund’s assets in the current exceptional market environment. This is consistent with the approach being taken across the broader industry. In response, we have suspended dealings in the Fund until such time that a more certain valuation can be ascertained.

The situation is being closely monitored and the decision to suspend will be reviewed regularly.

Sandy Wilson, fund manager for the Low Carbon Workplace (LCW) Fund, said: “We appreciate that suspending dealings in the Low-Carbon Workplace LP and its feeder, Threadneedle Low-Carbon Workplace Trust, may cause some inconvenience for our clients. However, with the lack of certainty surrounding the valuation of the assets in the fund’s assets this decision means that no unitholders will be disadvantaged, and we can ensure the fair treatment of all. We believe this is an appropriate measure to take during this period of exceptional uncertainty and we will review this decision regularly.”

Low-Carbon Workplace LP Fund invests in physical UK commercial property. We continue to believe property should form a part of a balanced portfolio for a long-term investor.

We thank our clients for their understanding and patience and will keep them informed via our website www.columbiathreadneedle.com/changes.

Important information about the Threadneedle Property Unit Trust (“the Fund”).

To protect the interests of investors in the Fund, Columbia Threadneedle Investments has temporarily suspended calculation of the Net Asset Value and dealing in Threadneedle Property Unit Trust (“the Fund”) with effect from 2pm on 24 March 2020. This means unitholders are temporarily unable to buy or sell units in the Fund. Any requests to transact received following suspension coming into effect will not been actioned and will not be accepted or queued. This decision has been taken by the Threadneedle Investments (Channel Islands) Board in consultation with the Trustees. The Jersey Financial Services Commission (JFSC) has been informed.

Columbia Threadneedle aims to ensure the fair treatment of all investors in our funds, whether they are transacting now or investing for the longer term.

Threadneedle Property Unit Trust has been suspended due to the fact that our independent property valuer, CBRE, has deployed a ‘market uncertainty clause’, which means that they are unable to provide an appropriate level of certainty regarding the valuation of the Fund’s assets in the current exceptional market environment. This is consistent with the approach being taken across the broader industry. In response, we have suspended Threadneedle Property Unit Trust until such time that a more certain valuation can be ascertained.

The situation is being closely monitored and the decision to suspend will be reviewed regularly.

Chris Morrogh, fund manager for the Threadneedle Property Unit Trust, said: “We appreciate that suspending Threadneedle Property Unit Trust may cause some inconvenience for our clients. However, our objective is to protect the interests of investors in the Fund by ensuring the fair treatment of all, whether they are transacting now or investing for the longer term. Our decision to suspend dealing will prevent any unitholders being disadvantaged as a result of those redeeming from the Fund or newly investing in it at an uncertain price. We believe this is an appropriate measure to take to manage the Fund during this period of exceptional uncertainty and we are committed to reviewing our decision regularly.”

Threadneedle Property Unit Trust invests in physical UK commercial property. We continue to believe property should form a part of a balanced portfolio for a long-term investor.

We thank our clients for their understanding and patience and will keep them informed via our website www.columbiathreadneedle.com/changes.

Important information about the TPEN Property Fund (“the Fund”).

To protect the interests of investors in the Fund, Columbia Threadneedle Investments has temporarily suspended dealing in the Threadneedle Pensions (TPEN) Property Fund (“the Fund”) from 12 noon on 20 March 2020. This means policyholders are temporarily unable to buy or sell shares in the Fund. Any requests to transact after the 11am dealing cut-off on 19 March have not been actioned and new requests will not be accepted. This decision has been taken by the TPEN Board. The Prudential Regulatory Authority (PRA) and the Financial Conduct Authority (FCA) have been informed.

Columbia Threadneedle aims to ensure the fair treatment of all investors in our funds, whether they are transacting now or investing for the longer term.

We have suspended the TPEN Property Fund due to the fact that our independent property valuer, CBRE, has deployed a ‘market uncertainty clause’, which means that they are unable to provide an accurate valuation of the Fund’s assets in the current exceptional market environment. This is consistent with the approach being taken across the broader industry. In response, we have suspended the TPEN Property Fund until such time that an accurate valuation can be ascertained.

We are monitoring the situation closely and will formally review this decision regularly.

Nathan Hargreaves, fund manager for the TPEN Property Fund, said: “We appreciate that suspending the TPEN Property Fund may cause some inconvenience for our pension clients. Our objective is to protect the interests of investors in the Fund by ensuring the fair treatment of all, whether they are transacting now or investing for the longer term. Our decision to suspend dealing will prevent any policyholders being disadvantaged as a result of those redeeming from the Fund or newly investing in it at an inaccurate price. We believe this is an appropriate measure to take to manage the Fund during this period of exceptional uncertainty and we are committed to reviewing our decision regularly.”

The TPEN Property Fund invests in physical UK commercial property. We continue to believe property should form a part of a balanced portfolio for a long-term investor.

We thank our clients for their understanding and patience and will keep them informed via our website www.columbiathreadneedle.com/changes.

Please note the suspension was last reviewed on 9 April 2020.

Important information about the Threadneedle UK Property Authorised Investment Fund (Threadneedle PAIF) and its Feeder Fund, Threadneedle UK Property Authorised Trust (Feeder Fund) (“the Fund”).

To protect the interests of investors in the funds, Columbia Threadneedle Investments has temporarily suspended dealing in the Threadneedle UK Property Authorised Investment Fund (Threadneedle PAIF) and the Threadneedle UK Property Authorised Trust (Feeder Fund) from 12 noon on 18 March 2020. This means investors are temporarily unable to buy or sell shares in the Threadneedle PAIF or its Feeder Fund. Any requests to transact after 12 noon on 17 March have not been actioned and new requests will not be accepted. We have taken this action following discussions with the funds’ depositary, Citibank Europe Plc, UK Branch. The Financial Conduct Authority (FCA) has been notified.

Columbia Threadneedle aims to ensure the fair treatment of all investors in our funds, whether they are transacting now or investing for the longer-term. The suspension of the Threadneedle PAIF is consistent with the FCA’s upcoming rules which require a fund to suspend if more than 20% of its assets cannot be accurately valued.

The Threadneedle PAIF’s independent property valuer, CBRE, has deployed a ‘market uncertainty clause’ which means that they are unable to provide an accurate valuation of the PAIF’s assets in the current exceptional market environment. This is consistent with the approach being taken across the broader industry. In response, we have suspended the Threadneedle PAIF and its Feeder Fund until such time that an accurate valuation can be ascertained. We are monitoring the situation closely and will formally review this decision every 28 days with our depositary.

Gerry Frewin, fund manager for the Threadneedle UK Property Authorised Investment Fund, said: “Our objective is to protect the interests of investors in the fund, by always ensuring the fair treatment of all investors, whether they are transacting now or investing for the longer-term. While we appreciate this may cause some inconvenience, our decision to suspend dealing will prevent any investors being disadvantaged as a result of those redeeming from the fund or investing new money into the fund at an inaccurate price. Consistent with FCA guidance, we believe this is an appropriate measure to take to manage the fund during this period of exceptional uncertainty. We thank our investors for their patience and will continue to provide updates to keep you informed.”

The Threadneedle PAIF and its Feeder Fund invest in physical UK commercial property such as warehouses, shopping centres, high street shops and offices around the UK. We continue to believe property should form a part of a balanced portfolio for a long term investor.

We thank our clients for their understanding and patience and will keep them informed via our website www.columbiathreadneedle.com/paif.

From 7 May 2020 we will be making changes to the following funds (“Funds”):

- Threadneedle Managed Bond Fund

- Threadneedle Managed Bond Focused Fund

- Threadneedle Managed Equity & Bond Fund

- Threadneedle Managed Equity Focused Fund

- Threadneedle Managed Equity Fund

- New composite indices - The changes include enhancing the Funds’ investment objective by including a benchmark index within each Fund’s investment objective.

- Reduction of fees - Following a review of the fees and charges that apply to the Funds, we will reduce the annual management fees on some unit classes and reduce the ongoing charges figure across all unit classes as set out in the appendix ‘Schedule of Fees’.

- Compulsory conversion clause - We have decided to include a compulsory conversion clause in the prospectus with effect from 1 March 2020. This will allow us to convert unit holdings from one unit class to another unit class in the same fund, where it is in investors’ best interests.

Please refer to the other relevant Q&A’s for further information on Compulsory Conversion clause, Transfer to cheaper share class and Withdrawal of Loyalty Bonus arrangements.

We have decided to include a compulsory conversion clause in the prospectus of the Threadneedle Managed Funds and the Threadneedle UK Property Authorised Trust with effect from 1 March 2020. This will allow us to convert unit holdings from one unit class to another unit class in the same fund, where it is in investors’ best interests.

Effective from 1 January 2020, we have discontinued charging performance fees on the following funds (“the Funds”):

- Threadneedle UK Absolute Alpha Fund

- Threadneedle American Extended Alpha Fund

- Threadneedle Global Extended Alpha Fund

- Threadneedle UK Extended Alpha Fund

- Threadneedle (Lux) American Extended Alpha

- Threadneedle (Lux) Global Extended Alpha

We have recently reviewed the information available to investors about our UK-based OEIC (open-ended investment company) funds and, as a result, we’re updating a number of our fund investment objectives and policies. This will provide investors with additional information regarding our investment approach. These updates will take effect from 7 August 2019.

From 31 August 2019, we are making changes to the name and investment objective and policy of the Threadneedle UK Corporate Bond Fund. The changes include:

- Changing its name to Threadneedle Sterling Corporate Bond Fund

- Broadening and clarifying the wording used to describe the investment objective and policy

From 1 August 2019, we are making changes to the Threadneedle Dynamic Real Return Fund. The changes include broadening and clarifying the wording used to describe the investment objective and policy of the Fund.

From the 5 August 2019, we are making changes to the Threadneedle Managed Funds range:

- Threadneedle Managed Bond Fund

- Threadneedle Managed Bond Focused Fund

- Threadneedle Managed Equity & Bond Fund

- Threadneedle Managed Equity Focused Fund

- Threadneedle Managed Equity Fund

The change involves some amendments to the wording of the objective and policy of the Funds to provide more clarity of how the funds are invested. Also, each of the Funds will show comparator benchmarks that can be used to measure their performance.

We are closing the Threadneedle Absolute Return Bond Fund on the 26 July 2019.

The Fund is being closed due to its relatively small size. The Fund’s assets have fallen to a level which makes it economically unviable to manage. We believe the closure is in the best interests of investors. To this end, we will be closing the fund on the 26 July 2019 (the Effective Date) and dealing in the Fund will be suspended from 12.01pm on 23 July 2019.

Please see the Shareholder Notification and Q&A for further details.

From the 1 July 2019, we are making changes to the Ethical UK Equity Fund. The changes are:

- An amendment to the investment objective and policy to reflect the Fund’s positive focus on sustainability and to clarify how the Fund is managed;

- Change of Fund name to “UK Sustainable Equity Fund” to reflect the changes to the objective and policy;

- Change of benchmark to the FTSE All Share index.

From the 1 July 2019, we are making changes to the name and the investment objective and policy of the UK Overseas Earnings Fund. The changes include:

- Changing its name to UK Equity Opportunities Fund

- Broadening and clarifying the wording used to describe the investment objective and policy and includes the addition of the performance benchmark for the purposes of performance comparison.

We have written to investors in the Threadneedle UK Property Authorised Investment Fund and the Threadneedle UK Property Authorised Trust, to let them know that with effect from 12/04/2019, the Funds will change from being dual priced on a quoted-spread basis to being dual priced on a full-spread basis. Further information can be found below.

We would like to inform you that due to a ten-day ‘Golden Week’ holiday period in Japan this year, non-dealing days will be declared on the Threadneedle Japan Fund from Friday 26 April until Monday 6 May 2019 inclusive. This means that investors will be unable to buy, sell, ISA transfer or switch shares in the Fund during this period until it reopens for dealing on Tuesday 7 May 2019. Further information can be found below.

From the 21 May 2019, we are making changes to the TIF Asia Fund, TSIF China Opportunities Fund and TSIF Global Emerging Markets Equity Fund.

The Funds are currently managed by Threadneedle Asset Management Limited (TAML), the investment manager of the Funds. The changes are as follows:

- Threadneedle Asia Fund and Threadneedle China Opportunities Fund (co-management) TAML will delegate some of its investment decisions to Threadneedle Investments Singapore (Pte.) Limited (TIS) for the Threadneedle Asia Fund and Threadneedle China Opportunities Fund. This will allow both co-managers and deputy managers from the Singapore office for these funds working in collaboration with TAML appointed fund managers.

- Threadneedle Global Emerging Markets Equity Fund Columbia Management Investment Advisers, LLC (CMIA) will become the investment manager for the Threadneedle Global Emerging Markets Equity Fund. TAML will no longer be the investment manager but will continue to provide investment advice and recommendations in relation to the Fund. This change will allow both lead and deputy managers from the US offices for this Fund.

In accordance with new European regulations, we have received authorisation from the Financial Conduct Authority, for the Threadneedle Sterling Fund to be categorised as a Short-Term VNAV Money Market Fund. To reflect the Fund’s new status, we will be making the following changes to the Fund, with effect from 1 May 2019.

- Changing its name to “Threadneedle Sterling Short-Term Money Market Fund”.

- Broadening and clarifying the wording used to describe the investment policy; including addition of the performance benchmark for the purposes of performance comparison.

From the 15 April 2019, we are making changes to the investment objective and policy of the Threadneedle American Select Fund. The new wording will make clear that at least 75% of the Fund will be invested in companies based specifically in the United States (US), or with significant US business operations. At the same time, the management team will be able to invest up to 25% of the Fund in companies outside the US.

We recently informed you that we will transfer the assets of certain share classes of the below listed UK-based funds into an equivalent fund within our established Luxembourg fund range. Please note these changes do not impact GBP share classes.

- American Extended Alpha Fund

- Asia Fund

- Global Extended Alpha Fund

- Global Select Fund

- UK Absolute Alpha Fund

We are pleased to confirm that the transfers have now been successfully completed. Further information can be found below.

We recently informed you of our proposal to transfer the assets of certain share classes of the below listed UK-based funds into an equivalent fund within our established Luxembourg fund range. Following the shareholder vote at the extraordinary general meetings held on 12 December 2018, we can confirm that the proposed transfers have now been approved.

- American Extended Alpha Fund

- Asia Fund

- Global Extended Alpha Fund

- Global Select Fund

- UK Absolute Alpha Fund

We recently informed you that we will transfer the assets of certain share classes of the below listed UK-based funds into an equivalent fund within our established Luxembourg fund range. Please note these changes do not impact GBP share classes.

- American Smaller Companies Fund (US)

- European Smaller Companies Fund

- Global Emerging Markets Equity Fund

- Global Equity Income Fund

We are pleased to confirm that the transfers have now been successfully completed. Further information can be found below.

We recently informed you that we will transfer the assets of certain share classes of the below listed UK-based funds into an equivalent fund within our established Luxembourg fund range. Please note these changes do not impact GBP share classes.

- American Fund

- American Select Fund

- European Select Fund

- UK Equity Income Fund

- UK Fund

We are pleased to confirm that the transfers have now been successfully completed. Further information can be found below.

We have written to investors about a proposed change to the following funds.

- American Extended Alpha Fund

- Asia Fund

- Global Extended Alpha Fund

- Global Select Fund

- UK Absolute Alpha Fund

We are planning to transfer the assets of investors in certain share classes of each fund listed above into an equivalent share class within our established Luxembourg fund range. Please note these changes do not impact GBP share classes.

The transfers will be made by a process called a scheme of arrangement.

We recently informed you of our proposal to transfer the assets of certain share classes of the below listed UK-based funds into an equivalent fund within our established Luxembourg fund range. Please note these changes do not impact GBP share classes.

- American Smaller Companies Fund (US)

- European Smaller Companies Fund

- Global Emerging Markets Equity Fund

- Global Equity Income Fund

Following the shareholder vote at the extraordinary general meetings, the results of the vote are detailed in the investor letter below.