Past performance is not a guide to future returns. An illustrative example. The presented asset is closed to new investors.

Overview

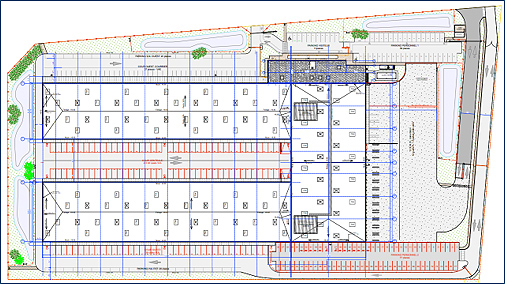

A brownfield speculative development, the previous building was demolished and replaced by a newly built, modern cross-docking facility delivering last mile logistics to city centre Lyon. The business plan included successfully pre-leasing the building during construction to the French Post Office all while benefitting from a strong leasing market and consistent rental growth.

Background

- The opportunity was sourced off-market via a developer with whom we entertain a long-term relationship.

- The property is located in the closest logistics market to the city of Lyon, which is primarily used for last mile delivery.

- Leasing led to the signature of a 9.5 years closed lease with the French Post Office (La Poste) within only 2 months following the beginning of construction.

- As La Poste had been identified early in the design process, we were able to tailor the project to their operation while maintaining a flexible cross-docking layout.

- Works were delivered in July 2021 following a 14-month construction period.

Key metrics

Location

9 avenue du 24 août 1944, Corbas (Lyon), France

Investment strategy

Speculative development

Sector

Logistics

Gross leasable area

12,862 sqm

Acquisition date

May-20

Insights

23 October 2024

Alternatives

Real Estate

Head of Research, Europe, Real Estate (EMEA)

UK Real Estate: Talking Points October 2024

UK Real Estate: Talking Points October 2024

Welcome to our quarterly snapshot of current real estate market trends.

18 September 2024

Alternatives

Real Estate

Head of Research, Europe, Real Estate (EMEA)

UK Real Estate – Overview Q2 2024

UK Real Estate – Overview Q2 2024

The UK economy recorded strong growth in the second quarter, with GDP growing by 0.6% in the 3 months to June, primarily led by growth in the services sector.

Read time - 3 min

17 July 2024

Alternatives

Real Estate

Head of Research, Europe, Real Estate (EMEA)

UK Real Estate: Talking points July 2024

UK Real Estate: Talking points July 2024

Political stability, rebased pricing, falling inflation and the expectation of rate cutting are collectively expected to provide a more supportive environment for UK real estate.

Read time 2 min

21 June 2024

Alternatives

Real Estate

Fund Manager & Co-head of Institutional UK Real Estate

Assistant Fund Manager

Green to gold: realising opportunities from the carbon transition

Green to gold: realising opportunities from the carbon transition

We explore the interventions required to monetise green energy, and how investors might benefit from the carbon transition.

Read time - 2 min

22 May 2024

Real Estate

Real Estate

Head of Research, Europe, Real Estate (EMEA)

UK Real estate – Overview Q1 2024

UK Real estate – Overview Q1 2024

Total returns for the UK commercial property market turned positive in Q1 2024.

Read time - 3 min

25 April 2024

Alternatives

Outlook

Head of Research, Europe, Real Estate (EMEA)

UK Real Estate: Talking Points April 2024

UK Real Estate: Talking Points April 2024

Our quarterly snapshot of current real estate market trends.

Read time - 2 min

15 February 2024

Alternatives

Real Estate

Head of Research & Analytics, Real Estate (US), Lionstone Investments

Head of Research, Europe, Real Estate (EMEA)

2024 Global Real Estate Outlook

2024 Global Real Estate Outlook

What's in store for real estate in 2024? Global megatrends and financial conditions will impact returns and sector allocation.

Read time - 4 min

20 December 2023

Alternatives - Real Estate Securities

Alternatives, Real Estate

Head of Property Investment, Thames River Capital

Portfolio Manager

Targeting relative value in listed real estate

Targeting relative value in listed real estate

With inflation data suggesting we are at or near the peak in interest rates and investors assessing scope for cuts in 2024, real estate equities have risen sharply from their lows.

Read time - 4 min

12 December 2023

Alternatives

Real Estate

European Fund Manager, Real Estate

Head of Research, Europe, Real Estate (EMEA)

The resurgence of Europe’s luxury high streets is gathering momentum

The resurgence of Europe’s luxury high streets is gathering momentum

High street retail markets across Europe are benefitting from the solid recovery of tourism, both international and domestic.

Read time - 3 min

You may also like

Investment strategies

We offer a broad range of actively managed investment strategies and solutions covering global, regional and domestic markets and asset classes.

Our funds

Columbia Threadneedle Investments has a comprehensive range of investment funds catering for a broad range of objectives.