- The impact of the food value chain to both the global economy and financial markets is huge

- But food systems face multiple challenges, from climate change to population growth and unsustainable practices

- There are investable opportunities with solutions to enhance the sustainability and health of our food systems, and financial markets can play a role in supporting these

Thus, UN Sustainable Development Goal 2, Zero Hunger, emphasises the importance of nutrition, food security and sustainable agriculture to global development and prosperity.¹ Other UN SDGs also relate to food, either directly, such as number 3, Good Health and Wellbeing, given the rise of food-related non-communicable diseases, and 14, Life Below Water, which includes a focus on sustainable fishing; or indirectly, such as goal 13, Climate Action, and goal 15, Life on Land, given the impact of farming on emissions and forestry (Figure 1).

In terms of global GDP, the share from agriculture, forestry and fishing is relatively modest at 3.5%, but there is a considerable range. For example, in low income countries this figure can be in excess of 25%.² When related areas such as food staples, retail and services are considered, the impact of the food value chain to the global economy is even greater.

This picture is similar for financial markets, which are exposed to food through asset classes such as commodities, but also through areas within conventional asset classes. For instance, we estimate that around 7% of the most commonly used global equity index, the MSCI All- Country World Index, is exposed to food-related health and nutrition issues through their business models.³

Critically challenged

- Climate change poses risks to global food and health

In 2017 alone, climate-related disasters caused acute food insecurity for around 39 million people across 23 countries.4 It is estimated that with global warming of 1.5°C above pre-industrial levels (the most conservative and “best-case” estimate of future warming), 35 million people would be exposed to crop yield changes. At 3°C (increasingly seen as likely) this is expected to be 1.8 billion.5

- Unsustainable past practices threaten the future

Nearly a third of fish stocks are overfished and a third of freshwater fish species assessed are considered threatened.6 Furthermore, it is estimated that agriculture and land use has accounted for 24% of global greenhouse gas emissions, and dairy and cattle around 40% of this total.7 At a time of increasing drought risk, agriculture is also the largest consumer of the earth’s available freshwater: 70% of “blue water” withdrawals from watercourses and groundwater are for agricultural usage.8

- Demographic growth increases pressure

It is expected there will be approximately 10 billion people on the planet by 2050, an increase of around 30% from today.9

- The health impact of food is increasingly of concern

One in eight adults are obese and 8.5% have diabetes.10

Technology and innovation

One avenue is the use of precision techniques: farm management based on observing, measuring and responding to conditions, with the goal of optimising returns while preserving resources. Through such solutions US firm Trimble, for example, helps improve farm yields by up to 30% while reducing water use by up to 20%.11 A development which addresses climate impact, meanwhile, is from Dutch company DSM, which has created a feed additive for cows that reduces internal fermentation and hence their methane emissions by 30%.12

Health and consumers

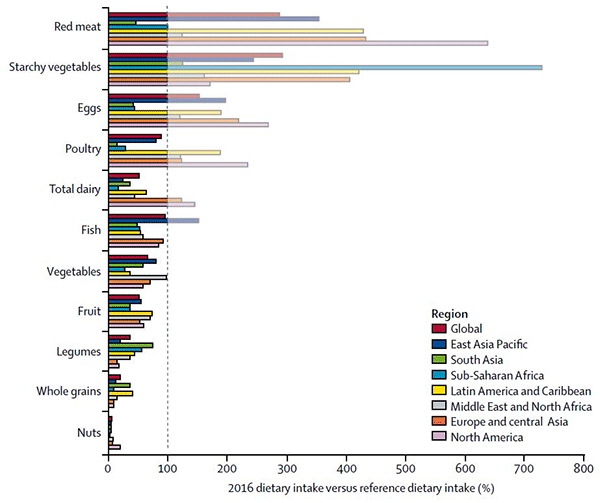

Sugar is not the only area of focus, with growing concerns about the overconsumption of meat. This was one of the key findings of the EAT-Lancet Commission on Food, Planet, Health, which is formed of more than 30 world-leading scientists and which quantitively describes a “healthy reference diet”. The findings showed the need for a substantial increase in the consumption of foods such as vegetables, fruits and whole grains, and a decrease in the consumption of red meat, sugar and refined grains in order to provide major health benefits, and also increase the likelihood of attaining the SDGs. Strikingly, it also found that globally meat consumption was more than 2.5x the recommended amount, while in the US this was over 6x (Figure 2).13

While demand for sugary products and red meat has persisted to date, the recent acceleration of demand for alternatives is even more striking. For instance, plant-based food sales growth was 10x that of all food sales growth in 2018 in the US.14 Testament to this is the recent success of Beyond Meat’s IPO which, at the time of writing, had soared 250% per share since its 2 May IPO.15 In the UK, meanwhile, a recent survey showed 45% of shoppers were actively looking for healthy snacks and 41% want snacks with less sugar.16