As the economy recovers and cyclical stocks begin to outperform, how should we think about the connection between equities and US Treasury yields?

A recent rapid increase in US Treasury yields has unsettled equity markets, and to understand this short-term volatility we need to look back to the fourth quarter of 2020. During this time, sector leadership in the market shifted quite dramatically from specific product and service growth-oriented companies to those that benefit from a revival in broader economic activity – cyclical industries such as energy, industrials, metals and mining.

At the onset of the coronavirus pandemic our thesis was that, contingent on the development of a safe and effective vaccine, it would likely take 10 quarters to see US economic activity return to pre-Covid levels. Over that time we expected the market to begin looking past the pandemic. This has played out as we expected, even if the timing was earlier and the rebound stronger than we had anticipated. Consistent with our view of the recovery, two important dynamics have pushed the market higher:

- Cyclical industries began to outperform secular growth companies. On a global scale we have also seen emerging markets outperform developed markets, which is usually an indicator of investor confidence in the strength of the global economy.

- Treasury yields rose, representing a concern that broader economic activity would create the risk – though not necessarily the reality – of higher inflation. But how can we make sense of the relationship between yields and equities?

Going back to basics, the stock market’s value is estimated using: a) current earnings/cash flow; b) estimates of the growth of those earnings/cashflow; c) a risk-free rate used to discount future earnings to the present-day value; and d) an uncertainty discount (known as the risk premium) that represents the prospect that estimates will not unfold as expected. This is applied in addition to the risk-free rate.

If all else remains unchanged, the higher the risk-free rate and/or the uncertainty discount go, the more the stock market’s value should fall. However, all else never remains equal – and it certainly hasn’t recently. As investors became more confident in late-2020 about the rate and timing of the global economic recovery, the uncertainty discount diminished, propelling stocks higher. US Treasury yields rose in response but did not keep up with the drop in uncertainty rate implied by the rally in stocks.

The relationship between A, B, C, and D above is simple to explain arithmetically, but as with any relationship, emotion plays a big part, at least in the short term. If you imagine an elastic band composed of 10-year yields and equity values, once you stretch the band the relationship between one end and the other distorts, and something must snap back to restore the equilibrium in the relationship.

Consequently, yields “snapped” higher to restore an equilibrium reflecting greater confidence in the recovery. The sectors and regions that will benefit most from the recovery are likely to continue to perform the best – but not evenly – over 2021, as confidence in the recovery ebbs and flows affecting short-term sentiment. Again, this is all very simple from an arithmetic point of view, but messy when investor emotion kicks in.

What about inflation?

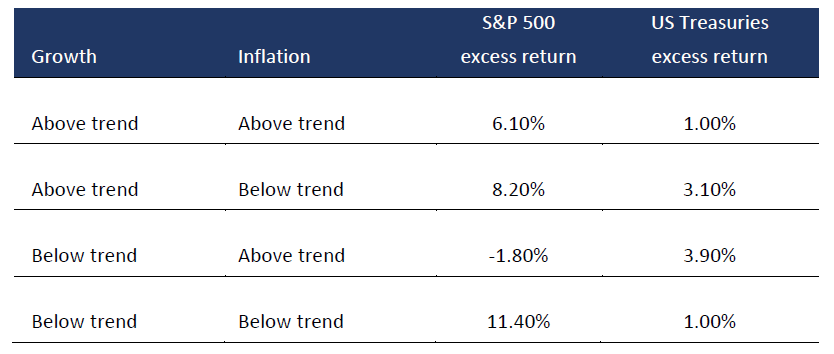

What about inflation? As a result there are also significant disagreements on the future path of inflation. Economists and investors often like to break down asset market returns into growth and inflation regimes (Figure 1). During times of uncertainty about inflation it is important to remember that, if growth remains above trend, we expect to see constructive returns for equities. This has been true whether inflation is above or below trend. Of course, outrageously high inflation or extreme levels of deflation can be disruptive to an economy and its equity market, but we do not believe there is serious threat of either of those scenarios.

Figure 1: Growth and inflation regimes

Source: Columbia Threadneedle based on the period 1 January-31 January 2021. Excludes recessionary periods. Treasuries are represented by the Ibbotson Intermediate Government index for the period 1 January 1970-31 December 1972 and Bloomberg Barclays Treasury index for the period 1 January 1973-31 January 2021. Both indexes are measures of the US Treasury market. Growth regimes were established using the Chicago Fed National Activity Index (CFNAI), a monthly index designed to gauge overall economic activity and related inflationary pressure. Inflation regimes were established using 36-month moving average of CPI inflation.

If economic recovery is strong but supply chains remain disrupted after Covid-19 lockdowns, there is a risk of higher inflation. However, central banks may look past that temporary phenomenon and wait to see what structural trends emerge. This uncertainty is exacerbated by some anxiety about stock market valuations given how far markets have risen since successful vaccines were announced. If a modest sell-off occurs, it could be quite healthy because high expectations should be tempered.

Summary

I remain confident that the downside risk is mild relative to recent gains. The reality of global economic recovery in the second half of 2021 will most likely restore balance to the relationship between investor expectations and outcomes.