Doing business with us

Fund charges and costs explained

When you buy a fund, there is a range of charges applicable, depending on how you invest.

The charges that you pay are used to cover the costs of running the fund, including our charge for managing the fund, in addition to the costs of distributing it. The value of your investment will reflect these charges and will be lower as a result.

If you have any queries please contact us.

Selecting the tabs below allows you to see full descriptions for all charges relevant to our UK OEIC and Luxembourg SICAV products.

OEIC fund charges and costs explained

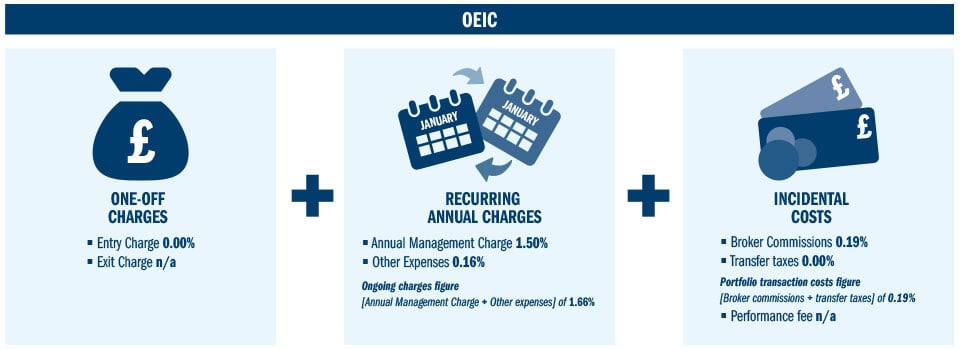

There are a number of charges and costs that are incurred when investing. The charges that an investor pays are used to cover the costs of running the fund, including our charge for managing the fund, in addition to the costs of distributing it. The value of an investment will reflect these charges and will be lower as a result.

Charges vary from fund to fund and between share classes. Further information about specific charges can be found in the relevant Fund Prospectus and on the Funds and Prices page of our website where you can search for your fund by name/ISIN.

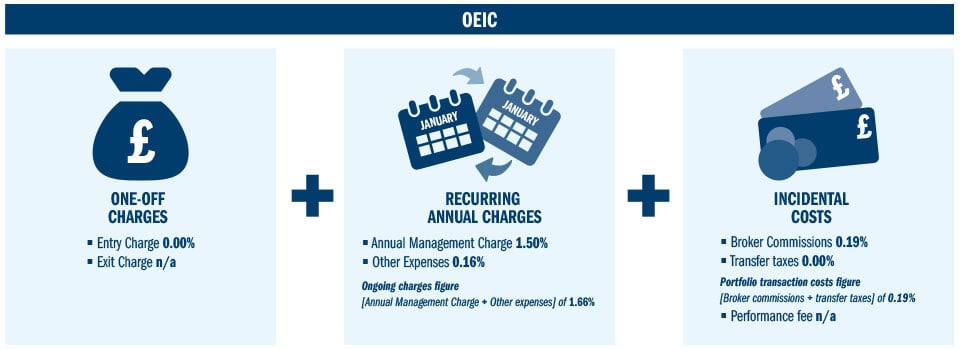

The total cost of your investment may comprise of the following:

Entry charge

This is often referred to as an initial charge and is the maximum that may be taken from an investment before the deal is placed in your chosen fund.

For dual-priced funds, the initial charge is included in the price at which an investor buys into the fund, this is known as the bid/offer spread and is the difference between the quoted bid and offer prices.

Columbia Threadneedle Investments does not currently apply any entry charges on its UK domiciled fund ranges.

Exit charge

This may also be referred to as a redemption charge and relates to the amount of money thatmay be taken from an investment before the proceeds of your investment are paid out.

Columbia Threadneedle Investments does not charge exit fees.

Switching charge

This is a charge levied when an investor chooses to switch from one share class in a fund to another share class in the same fund.

Columbia Threadneedle Investments does not charge switching fees.

There are a number of charges and costs borne by the funds each year as described below. The Ongoing Charges Figure (OCF) is an industry standard way of measuring the aggregate effect of a number of these charges.

Ongoing charges figure (OCF)

The OCF is based on the last year’s expenses and may vary from year to year. It includes charges such as the fund’s annual management charge, registrar fee, custody fees and distribution cost but excludes the costs of buying or selling assets for the fund (unless these assets are shares of another fund)

The following form part of the OCF:

- Annual management charge

This is a charge paid annually to Columbia Threadneedle Investments for managing an investment in a fund. - Registrar fee

This is a fee paid in return for Columbia Threadneedle paying or satisfying certain ongoing registration and general expenses. At any particular time the actual amount of ongoing registration and general expenses may be more or less than Columbia Threadneedle Investments collects from the fund.

The following form part of the registrar fee:

- fees and expenses in respect of establishing and maintaining the register of Shareholders and related functions including the fees of the registrar;

- expenses incurred in distributing income to Shareholders;

- fees in respect of the publication and circulation of details of the Net Asset Value and prices;

- fees and expenses of tax, legal and other professional advisers of the Company;

- costs of convening and holding Shareholder meetings (including meetings of Shareholders in any particular Fund, and a particular Class within a Fund);

- costs of printing and distributing reports, accounts and any prospectus, publishing prices and any costs incurred as a result of periodic updates of any prospectus and any other administrative expenses;

- fees connected with the listing of Shares on the Stock Exchange; and

- Report & Account fees.

- Custody (Safe keeping) fee– fee charged by the Depositary and Custodian who are the legal owners of the fund’s property and are responsible for safe keeping of the assets.

- Custody transaction fee – transaction expenses incurred by the Depositary and Custodian who are the legal owners of the fund’s property and are responsible for safekeeping of the assets.

- Audit fee – fees and expenses of the funds’ Auditors.

- Regulatory fee – fees of the Financial Conduct Authority and the corresponding periodic fees of any regulatory authority in a country or territory outside the United Kingdom in which Shares are or may be marketed.

In addition, there are further incidental annual charges and costs that are not part of the OCF:

Portfolio transaction costs (PTC)

This includes the expenses that arise from selling or buying investments in the fund, including redemption fees, transfer fees and broker commissions. Costs for a property fund may be significantly higher than an equity or bond fund, due to the additional transaction costs associated with buying or selling property.

Please note that the Portfolio Transaction Costs likely to be incurred as a result of large subscription/redemption requests are factored into the Dilution levy/adjustment rates applied to these deals.

For funds that invest in other funds there will be costs associated with the underlying funds. For detail of how this works, please consult the Prospectus.

Property Expense Ratio (PER)

There are a number of costs related to running and maintaining property funds that are not covered as part of the Ongoing Charges Figure (OCF). These additional costs are grouped together to form the Property Expense Ratio (PER), which includes:

- Non-recoverable property management fees

- Service charge shortfalls and holding costs such as empty rates and security

- Rent review and lease renewal costs

- Maintenance and repairs (not improvements)

- Property insurance costs/rebates

- Amortised debt- financing fees/costs

- Debt valuation fees

- Marketing of vacant space

- Project management fees (where not capitalised)

The costs associated with the Property Expense Ratio apply to the following:

- Threadneedle UK Property Authorised Investment Fund (Threadneedle PAIF)

- Threadneedle UK Property Authorised Trust (Threadneedle PAIF Feeder Fund)

Funds can be either single or dual-priced. A single-priced fund is bought and sold at the same price, subject to a potential dilution levy/adjustment (please see definition below).

Dual-priced funds have an offer price at which you buy, and a lower bid price, at which you sell.

View full list of funds within each range.

This table shows the pricing policy for the Threadneedle Investments UK domiciled fund range.

Funds range | Pricing policy |

|---|---|

Threadneedle Investment Funds (TIF) | Single-priced with potential Dilution Adjustment |

Threadneedle Specialist Investment Funds (TSIF) | Single-priced with potential Dilution Adjustment |

Threadneedle Opportunity Investment Funds (TOIF) | Single-priced with potential Dilution Adjustment |

Threadneedle UK Property Authorised Investment Fund | Dual-priced |

Threadneedle UK Property Authorised Trust (feeder fund) | Dual-priced |

Single-Priced Funds

Dilution adjustment

A single-priced fund calculates one price at each valuation point. This means that an investor will buy shares at the same price as another investor who sells shares at the same time.

When the fund buys or sells investments however, certain transactional costs are incurred. For this reason, our single-priced funds reserve the right to apply a dilution adjustment, in order to protect investors from the impact of transactional costs arising from large scale movements into or out of a fund.

Funds that operate a dilution adjustment will adjust the fund’s price if required to protect an investment from the impact of other investors joining or leaving the fund.

The amount of any dilution adjustment is calculated by reference to the estimated cost of dealing in the underlying investments. The estimated percentage impact of these adjustments is detailed in the prospectus for each fund.

Dual-Priced Funds

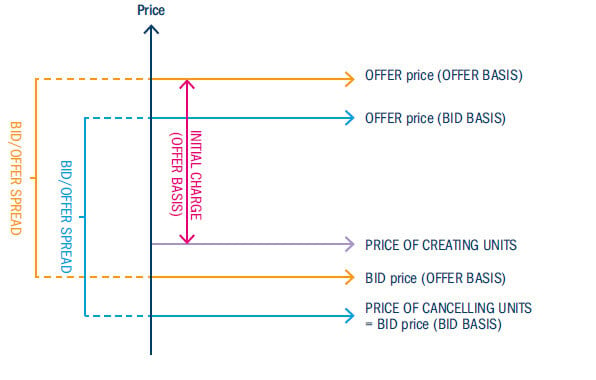

With dual-priced funds, there is a separate price for buying and selling units in the fund. The difference between the buying and selling price is known as the bid/offer spread.

The bid/offer spread broadly comprises the initial charge plus the difference between the buying and selling prices of the underlying investments plus any other costs involved in buying or selling the underlying investments.

The operation of dual pricing means that when investments are bought or sold as a result of other investors joining or leaving the fund an investment is sheltered from the costs of these transactions.

The buying (offer) and selling (bid) prices of the fund are generally dependent on whether the fund is experiencing more subscriptions than redemptions (net inflows/offer basis) or more redemptions than subscriptions (net outflows/bid basis).

Offer basis

On a net inflow basis, the prices originate from the buying price of the underlying investments. The buying (offer) price will be the price of creating a new unit (cost of buying underlying investments plus any related costs) with the addition of any initial charge. The selling (bid) price is then derived as the buying (offer) price minus the bid/ offer spread.

Bid basis

On a net outflow basis, the prices originate from the selling price of the underlying investments. The selling (bid) price will be the price of cancelling a unit (proceeds from selling the underlying investments minus any related costs).

It is not always possible to support a narrow bid-offer spread within our property funds (compared to the full costs of dealing in the underlying properties). In these circumstances, in order to protect existing investors from such costs, the management company may deal any large subscription or redemption requests at the creation or cancellation price, as appropriate.

Please note that if you invest through a platform, trades are aggregated. Consequently, all this may mean that several smaller deals are treated as a large deal.

For examples on the operation of Performance Fees for the applicable funds, please refer to the relevant Fund Prospectus.

For examples on the operation of Performance Fees for the applicable funds, please refer to the relevant Fund Prospectus.

SICAV fund charges and costs explained

There are a number of charges and costs incurred when investing in the funds of our SICAV, Columbia Threadneedle (Lux). The charges that you pay are used to cover the costs of running the fund, including our charge for managing the fund, and the costs of distributing and administering it. The value of your investment will reflect these charges and will be lower as a result of them.

Charges vary from fund to fund and from share class to share class. Further information about specific charges can be found in the relevant Fund Prospectus and on the Funds and Prices page of our website where you can search for your fund by name/ISIN.

The total cost of your investment may comprise of the following:

Entry charge

This is often referred to as the initial charge or entry charge and may be taken from an investment (initial or subsequent investment) before the investment is placed or shares are purchased.

We do not normally apply entry charges, but if you buy our funds through certain distributors they may apply an entry charge.

Exit charge

This may also be referred to as the redemption charge and relates to the amount of money that may be taken from an investment before the proceeds of your investment are paid out.

Columbia Threadneedle Investments does not charge exit fees to UK investors.

Exchange fee or switching charge

This is a charge that may be taken from an investment should an investor decide to switch money from one share class or fund to another share class or fund of the SICAV.

The maximum fee that can be charged for any of the SICAV funds is 0.75% of the value of your investment. For further information regarding switching please refer to the section of the SICAV’s prospectus with the heading “Exchange Privilege”.

There are a number of charges and costs borne by the funds each year as described below. The Ongoing Charges Figure (OCF) is an industry standard way of measuring the aggregate effect of a number of these charges.

Ongoing charges figure (OCF)

The OCF is based on the last year’s expenses and may vary from year to year. It includes charges such as the fund’s asset management fee, registration fee, custody fees and distribution cost but excludes the costs of buying or selling assets for the fund (unless these assets are shares of another fund). For any new funds or share classes, the OCF may be estimated until a full year’s expenses are available.

The following form part of the OCF:

- Asset management fee

This is a charge paid to us, or any sub-advisors, for managing your investment in a fund. It varies from fund to fund, and also from share class to share class. The fees are accrued each day and paid to us each month.

- Operating expenses

This is a fixed fee that covers the costs of operating the SICAV and includes, among other things:

- taxes;

- expenses for legal and auditing services;

- cost of printing proxies, share certificates, shareholders’ reports and notices, prospectuses and Key Investor Information and other promotional expenses;

- fees and charges of the custodian* and its correspondents, and of the domiciliary agent, administrative agent, registrar and transfer agent and of any paying agent;

- listing fees;

- fees of unaffiliated directors of the SICAV, expenses of the directors and officers of the SICAV and the subadvisors relating to attendance at meetings of the directors and of the Shareholders of the SICAV;

- translation costs, accounting and pricing costs (including the calculation of the net asset value per share);

- regulatory fees;

- insurance, litigation and other extraordinary or non-recurring expenses; and

- all other expenses properly payable by the SICAV.

Details of the operating expenses charged for each share class can be found in the appendices to the prospectus of the SICAV. Threadneedle Management Luxembourg S.A. bears the excess of any operating expenses incurred above the annual rate, and is entitled to retain any surplus operating to the extent that the fees received exceed the actual expenses of the SICAV.

*Please note that for certain share classes, the custody fees aren’t included in the operating expenses. Please refer to the SICAV’s prospectus for full details.

Performance fee

There are a number of our funds that charge a performance fee if certain performance criteria are met. For further information please refer to the SICAV’s prospectus.

The performance fee is a payment made to Threadneedle Management Luxembourg S.A., or any sub advisors, for generating returns in excess of a set target. It is paid in addition to the asset management fee. If the performance of the fund does not meet this target, a performance fee will not be payable. There is no maximum fee.

Performance fees apply to the following SICAV funds:

- CT (Lux) Pan European Absolute Alpha

For further information on the operation of the performance fee, including worked examples, please refer to the SICAV prospectus.

Portfolio transaction costs (PTC)

This includes the expenses that arise from selling or buying investments in the fund, including redemption fees, transfer fees and broker commissions. These occur as part of the day-to-day active management of the fund and also as a result of the fund receiving subscriptions and redemptions (although in the case of subscriptions and redemptions over a certain threshold, the dilution adjustment will cover the portfolio transaction costs).

If you are invested in a fund that invests in other funds there will be costs associated with the underlying funds.

For detail of how this works, please consult the Prospectus.

Dilution adjustment

The SICAV funds operate a single pricing policy (the funds are bought and sold at the same price) and we reserve the right to charge investors a dilution adjustment when buying or selling shares in a SICAV fund. This is to protect existing shareholders from the costs of buying or selling underlying investments following large purchases or sales of shares of the relevant funds. The amount of any such dilution adjustment is calculated by reference to the estimated costs of dealing in the underlying investments. The dilution adjustment results in an increase in the buying price of the fund (in the case of inflows), or a decrease in the selling price (in the case of outflows).

Dilution adjustment affects everyone who deals on a particular day when there are large net inflows into or outflows from a fund. Details of the dilution adjustment can be found in the section of the SICAV’s prospectus with the heading “Dilution Adjustment”.

Under current legislation, investors that are not resident in Luxembourg are not subject to capital gains or income tax unless they have a permanent establishment in Luxembourg to which the share capital of the SICAV is allocated.

Retail share classes of the SICAV are subject to a tax of 0.05% per annum (“taxe d’abonnement”) based on the amount invested in the SICAV at the end of each calendar quarter. Institutional share classes are also subject to a taxe d’abonnement of 0.01%. The “taxe d’abonnement” is included in the operating expenses, as described in the Annual Charges section.

Columbia Threadneedle does not offer tax advice. If you are unsure about any tax related issues you should consult a tax adviser.

For examples on the operation of performance fees for the applicable funds, please refer to the SICAV prospectus.

You may also like

Our Capabilities

We offer a broad range of actively managed investment strategies and solutions covering global, regional and domestic markets and asset classes.

Our funds

Columbia Threadneedle Investments has a comprehensive range of investment funds catering for a broad range of objectives.