Nature, and the resources and services it provides, underpins the economy and sustains life on earth. Yet indicators on the health of ecosystems are heading in the wrong direction, according to the Intergovernmental Panel on Biodiversity and Ecosystem Services.

- Companies causing negative impacts on nature will face increased risks and costs

- Companies’ operations and supply chains are at increasing risk of disruption

- Increased systemic and sovereign risks

- Shifting financial flows and new investment opportunities

We will assess each of these to identify impacts for companies and portfolios.

1. Companies causing negative impacts on nature

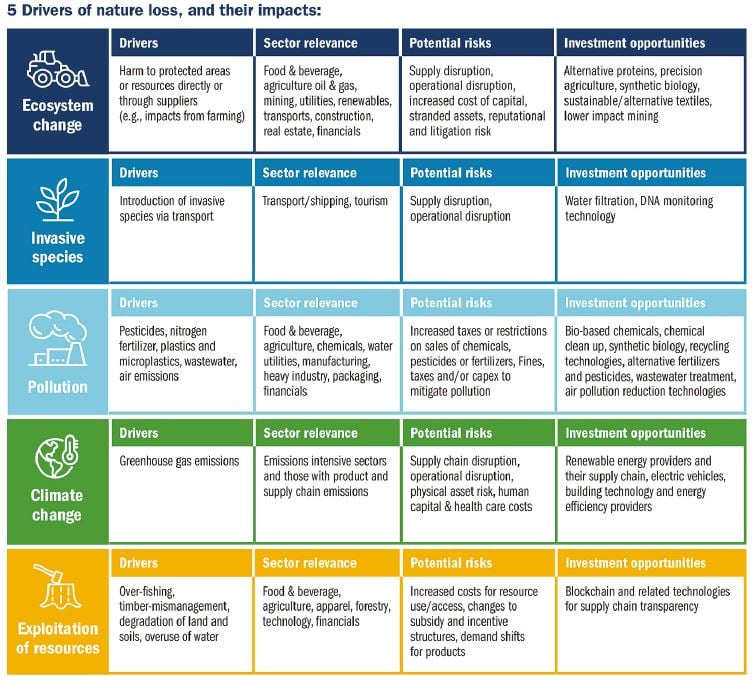

Figure 1: Company contributions to nature loss

2. Disruption to companies’ operations and supply chains

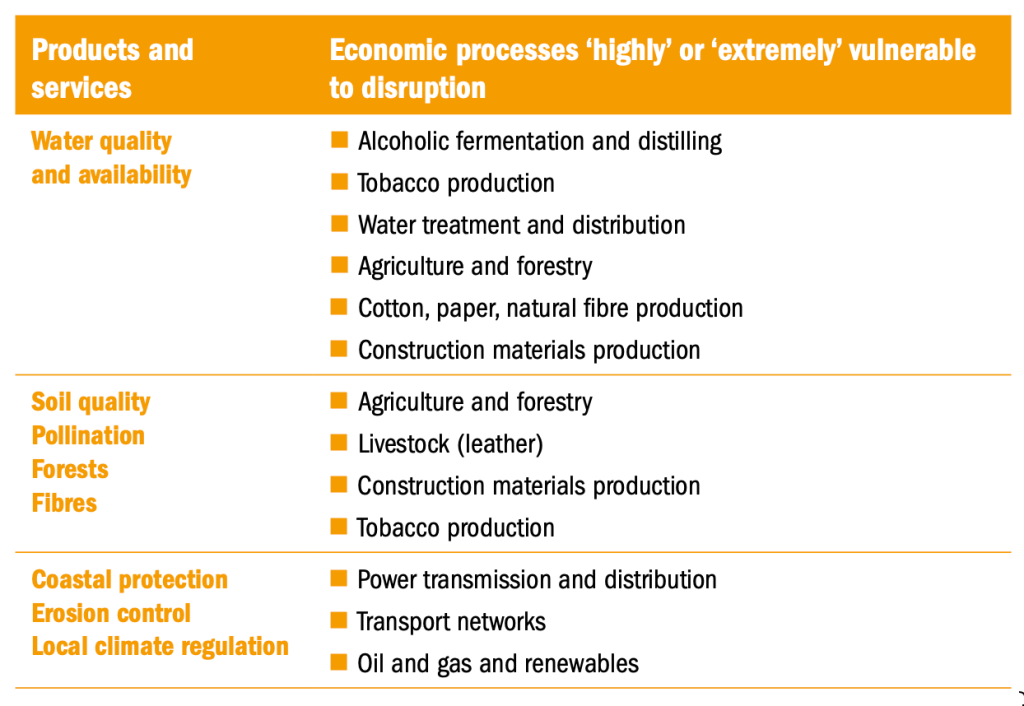

Figure 2: The disruption of products and services

3. Increased systemic and sovereign risk

4. Financial flows and investment opportunities

Avoiding harm and finding new opportunities

The next phase of the EU Taxonomy may steer investment towards companies that positively impact biodiversity. However, we think the draft criteria are narrowly defined, potentially leading to only a sliver of companies being able to evidence eligibility. More positively, we believe the development of this theme will support long-term investment opportunities

in technologies that can increase productivity in the use of resources (Figure 1).

Conclusion

Nature and biodiversity loss is a complex and fast-evolving theme. Economic conditions in 2022 may prove a hiccup in efforts to reduce nature loss, but over time the scale of the risks will increase pressure to reduce impacts and to remedy damage. Milestones such as the UN’s COP15 negotiations on a global biodiversity agreement, related regulatory proposals and initiatives such as the Taskforce for Nature-related Financial Disclosures will give an indication of the pace of evolution, and will remain a focus in our research and engagement.

Food & Materials transition engagement: Biodiversity and deforestation

Company: The Home Dept

Sector and country: Retail, USA

Why we engaged

We wanted to better understand Home Depot’s sourcing commitments and

encourage their further development.

How we engaged

Video call with VP of Sustainability and several portfolio managers.

What we learnt

The company’s disclosure is lacking in detail, but it does have granular

information on the origin and certification status of its wood products, which it will disclose. The company has also committed to respond to the CDP Forests questionnaire. Home Depot’s wood sourcing policy will be expanded to a wider range of at-risk forest regions – including those where it does not source – to avoid ambiguity. Sourcing of slower growing timber used in building materials, such as spruce and hard pine, poses a barrier to Home Depot adopting more comprehensive commitments on deforestation and forest degradation.

Outcome

Management heard our views on the need for continuous improvement

in policies and disclosure on wood sourcing. We will review its progress

and updated disclosures next year. Its policies on deforestation will rightfully remain a focus, given growing biodiversity and climate risks. The discussion highlighted the need to balance progress on company commitments with ensuring they are meaningful, achievable and avoid unintended consequences.