CT Junior ISA

Tax efficient savings for your child

A Stocks and Shares Junior ISA allows you to invest tax-efficiently for the child in your life with a current annual limit of £9,000 for the 2024/25 tax year. A Junior ISA is an account that acts as a wrapper to hold a range of different investments.

The CT Junior ISA (CT JISA) lets you tap into the potential of the stock market and the skills of our fund managers to potentially help your child with those future goals, such as university fees, a deposit on their first home or that dream trip around the world.

Reasons to choose Columbia Threadneedle for a CT Junior ISA

No online dealing charges

Benefit from our expertise

Responsible investing

Cost-effective investing

Getting started is easy

3 steps toward

your goals

Choose a savings plan

Choose your strategy

Invest in your future

Let's talk about risk

Like all investments, our Stocks and Shares Junior ISA comes with a level of risk. Because the money in the account is invested in stocks and shares, the value of your investments can both rise and fall. That means your child might get back less than you originally put in. A Junior ISA account is available to any child under the age of 18 who lives in the UK, unless they have a Child Trust Fund – in which case, they won’t be eligible. Remember, a Junior ISA belongs to the child. Only they can withdraw the funds when they turn 18, so consider this savings product a long-term investment. Be aware that tax rules may change in the future, and tax treatment depends on your child’s individual circumstances.

A cost-effective way to invest

Invest up to a maximum of £9,000 in the 2024/25 tax year.

Invest from as little as £25 per month, with no dealing charges on investments made by a monthly direct debit.

You can also make one-off contributions from £100. Investment instructions can be made online without any dealing charges. If you need to send instructions via post, there will be a £12 charge for each fund selected.

There’s an annual charge of £25 + VAT for the CT JISA and Government stamp duty of 0.5% applies on purchases of UK shares.

Friends and family can gift money to your child’s account too – whether they are grandparents, godparents, or friends.

Make sure you read the pre-sales costs disclosure before you invest. You will need to sign a declaration on our forms that confirm you have read it.

Transfer your JISA to Columbia Threadneedle

Switching your Junior ISA to us is easy, all you need to do is complete a transfer form and we will take care of the rest. The process will normally be complete in around four weeks although may take a little longer depending on your current provider.

You can transfer a stocks and shares JISA or a cash JISA to a CT JISA (or both, if you have one of each). Once we’ve received your transfer form, we contact your existing JISA plan provider and arrange the transfer for you. We only accept transfers as cash, and we can’t accept further contributions into the new CT JISA until your existing JISA manager has completed the transfer. Any transfers from an existing stocks and shares JISA must be done in full – you can’t make a partial or previous tax years’ transfer.

Invest in our Investment Trusts through a CT JISA

A Columbia Threadneedle Stocks and Shares Junior ISA allows you to choose from a diverse range of investment trusts. These trusts offer you different ways to invest, such as in equities, bonds, property, and private equity. Choosing a mixture of these trusts enables you to spread your investments and potentially minimise risk.

Each trust operates differently. You can pick options that focus on capital growth, income, or both. Some invest in the UK, while others take a global approach.

Please see the Key Information Documents (KIDs) for further details on the risks for each trust. View the latest performance of our Investment Trusts.

Invest now

Columbia Threadneedle offer a range of Savings Plans designed to make investing easy.

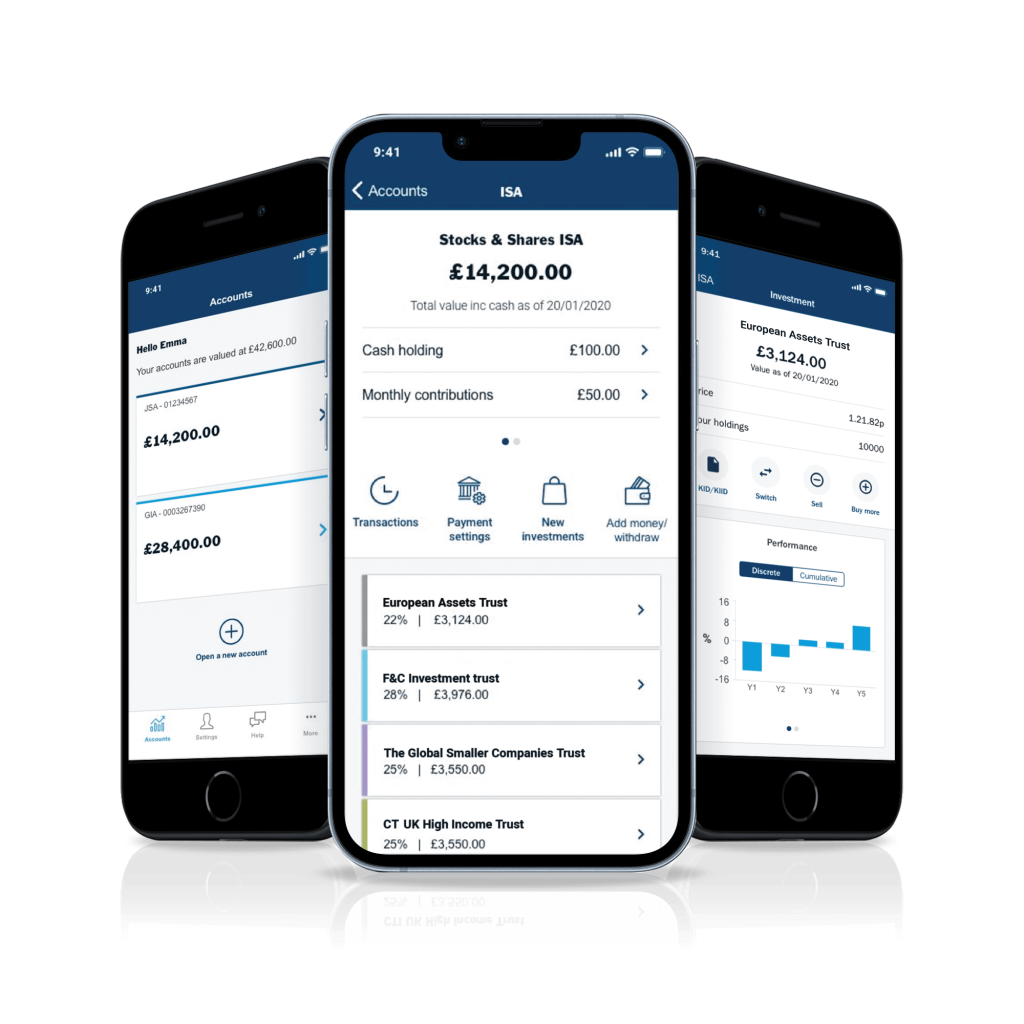

Start from £25 a month or one off £100, and there are no charges when you deal using our Investor Portal.

Frequently asked questions

You can open a Junior ISA for children (under 18) who live in the UK. Only parents (or those with parental responsibility) can open a Junior ISA for them.

If your child already has a CTF they cannot also have a Junior ISA. You can however, transfer a CTF into a Junior ISA. We’ll open your CT JISA for you as part of the transfer application process – simply download and complete the form and we’ll do everything else. It’s not possible to transfer a CTF to a Junior ISA online.

Grandparents, godparents, friends and relatives can all contribute to your child’s Junior ISA by using our Junior ISA top-up form. Only the Registered Contact is allowed to make investment decisions.

Until the child reaches 16 the parent who opens the account (Registered Contact) can choose the type of investments held. From 16, to help the child develop a more thorough understanding of how savings work, they can control the investment decisions should they wish – though they cannot make any withdrawals until they reach 18.

No, funds in the Junior ISA cannot be withdrawn until the child reaches 18.

There is no tax to pay on any return on your investment, including dividends or interest received. You’ll also pay no capital gains tax (CGT), which may be relevant if you have used up all your annual CGT allowance.